Macro Regime Tracker: FOMC RISK

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

We are heading into FOMC tomorrow, and I laid out the most recent dynamics in the video below, as well as the connected report: LINK

Most Recent Macro Research:

All of the major pieces for WHERE we are can be found here:

Liquidity Tides and Strategic Positioning in Bitcoin and Gold (IMPORTANT ONE)

The Credit Cycle Is Built on the Consumer—and Will End With Them

All of the systematic models have been updated below. I will be sending out an additional piece tomorrow morning for paid subscribers, breaking down the flows for BTC and risk assets, so be on the lookout for that.

Main Developments In Macro

US Macro & Rates

*US 30-YEAR TREASURY YIELD FALLS 10BPS TO TRADE AT 4.86%

*US TWO-YEAR FRNS DISCOUNT MARGIN AT 0.159%

*US AWARDS 0.8% OF TWO-YEAR FRNS TO DIRECT BIDDERS

*US TWO-YEAR FRNS BID/COVER RATIO 2.81 VS. 2.79 PREVIOUS AUCTION

*US TREASURY SELLS $32.04 BILLION IN TWO-YEAR FRNS

*US AWARDS 59.7% OF TWO-YEAR FRNS TO INDIRECT BIDDERS

US-China Trade Talks & Tariff Developments

*HASSETT: NUMBER OF DEALS VERY CLOSE, JUST AWAITING TARIFF RATE

*HASSETT: WE DON'T WANT CHINA TO BECOME AI STANDARD FOR CHIPS

*HASSETT ON NVIDIA H2O CHIPS: WE WANT CHINA BUYING OUR CHIPS

*HASSETT: EXPECT TRUMP WILL BE VERY PLEASED WITH CHINA TALKS

*HASSETT: TRUMP WILL SEE FINAL DETAILS ON CHINA TALKS TOMORROW

*BESSENT: TARIFFS SHORT-TERM IF NEGOTIATIONS IN GOOD FAITH

*BESSENT: SNAP-BACK TARIFFS COULD BE FEW DAYS, FEW WEEKS

*BESSENT THREATENS TO INCREASE EU TARIFF IF DEAL ISN'T HELD UP

*BESSENT: ON PAPER, THE EU DEAL IS DEAL OF CENTURY

*BESSENT: TRUMP BELIEVES EU DEAL IS A GOOD ONE

*BESSENT: EU $600B WILL BE 'CLOSELY MONITORED'

*BESSENT: EVERYONE CAN SEE ARC OF WHERE TRADE DEALS ARE GOING

*BESSENT: CHINA REBUKED US URGING ON RUSSIAN OIL

*BESSENT: XI INVITED TRUMP TO COME TO BEIJING

*BESSENT: CHINA JUMPED THE GUN A LITTLE ON 90 DAY PAUSE

*BESSENT: 90 DAY TRUCE PENDING TRUMP APPROVAL

*TRUMP: HEARD FROM BESSENT MEETING WITH CHINA WENT WELL

*TRUMP: PROBABLY MEET XI BEFORE END OF YEAR

*TRUMP: XI WANTS TO MEET

*BESSENT: TRUMP TO DECIDE IF CHINA TARIFF PAUSE CONTINUES

*GREER: SECTION 232 TARIFFS WILL BE APPLIED GLOBALLY

*GREER: CHINA'S BIGGEST CONCESSION CAME WITH RARE EARTH MAGNETS

*CHINA, US SHARE BROAD SPACE FOR TRADE COOPERATION: VICE PREMIER

*BESSENT: TARIFF LEVELS WILL HAVE TO DO WITH CHINA ECONOMY

*BESSENT: DERISK WITH RARE EARTHS, CHIPS, MEDICINES

*BESSENT: EXRESSED REGRET ABOUT CHINA SELLING DUAL-USE TECH

*BESSENT: OVERALL TONE OF CHINA MEETING WAS VERY CONSTRUCTIVE

*BESSENT: EXPRESSED CONCERN FOR CHINESE OVER-CAPACITY GLOBALLY

*BESSENT: CHINESE WERE MORE OPEN TO WIDE-RANGING DISCUSSION

*BESSENT: CHINESE SURPRISED BY MAGNITUDE OF US TRADE DEALS

*BESSENT: TRUMP WILL MAKE FINAL CALL ON CHINA TARIFF TRUCE

*GREER: DISCUSSED SECTORAL TARIFFS WITH CHINA

*GREER: WE'VE SEEN IMPROVEMENTS ON MAGNETS FOR US COMPANIES

*BESSENT: WE WANT TO SEE DURABLE PROGRESS

*BESSENT: DID NOT TALK ABOUT TIKTOK IN CHINA TALKS

*GREER: NO AGREEMENT ON EXPORT CONTROLS

*BESSENT: WE KEEP EXPORT CONTROLS SEPARATE FROM TRADE

*CHINA PLANS TO EXTEND TRUCE OF ITS COUNTERMEASURES AGAINST US

*CHINA SAYS IT AGREES WITH US TO EXTEND TARIFF TRUCE

*CHINA, US WILL CONTINUE CLOSE COMMUNICATION: LI

*US, CHINA AGREE TO EXTEND TRADE TRUCE: LI

*CHINA, US EXCHNGAED VIEWS ON MACROECONOMIC ISSUES: LI

*CHINA, US AWARE IMPORTANCE TO SAFEGUARD SOUND TRADE TIES: LI

*CHINA, US TRADE TALKS ARE CONSTRUCTIVE ON MAJOR TOPICS: LI

*CHINA, US TALKS WERE IN-DEPTH: LI

*CHINA, US TALKS WERE CANDID :LI

*CHINA’S TRADE ENVOY LI CHENGGANG SPEAKS IN STOCKHOLM

*CHINA'S VICE MINISTER OF COMMERCE LI CHENGGANG BRIEFS

*CHINA STARTS BRIEFING IN STOCKHOLM ON TRADE TALKS WITH US

*US, CHINA END THE SECOND DAY OF TRADE TALKS IN STOCKHOLM

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

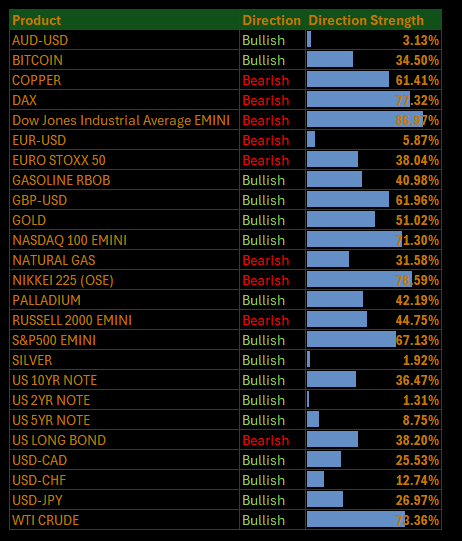

Here is a summary of all models and their directional strengths:

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

US Market Wrap: S&P Slides as Breadth Buckles, Risk Aversion Builds into Fed, Tariff, and Tech Storm

The S&P 500 dropped 0.58% on Tuesday, snapping a six-day winning streak and confirming a decisive shift in market tone. Despite no overt headline shock, internals told a story of growing fragility: breadth collapsed, defensives cracked, and the rally narrowed dangerously into Energy and select low-beta segments. With the Fed, QRA, and earnings from Big Tech all looming, positioning took a cautious turn, and the macro trade-offs became painfully visible.

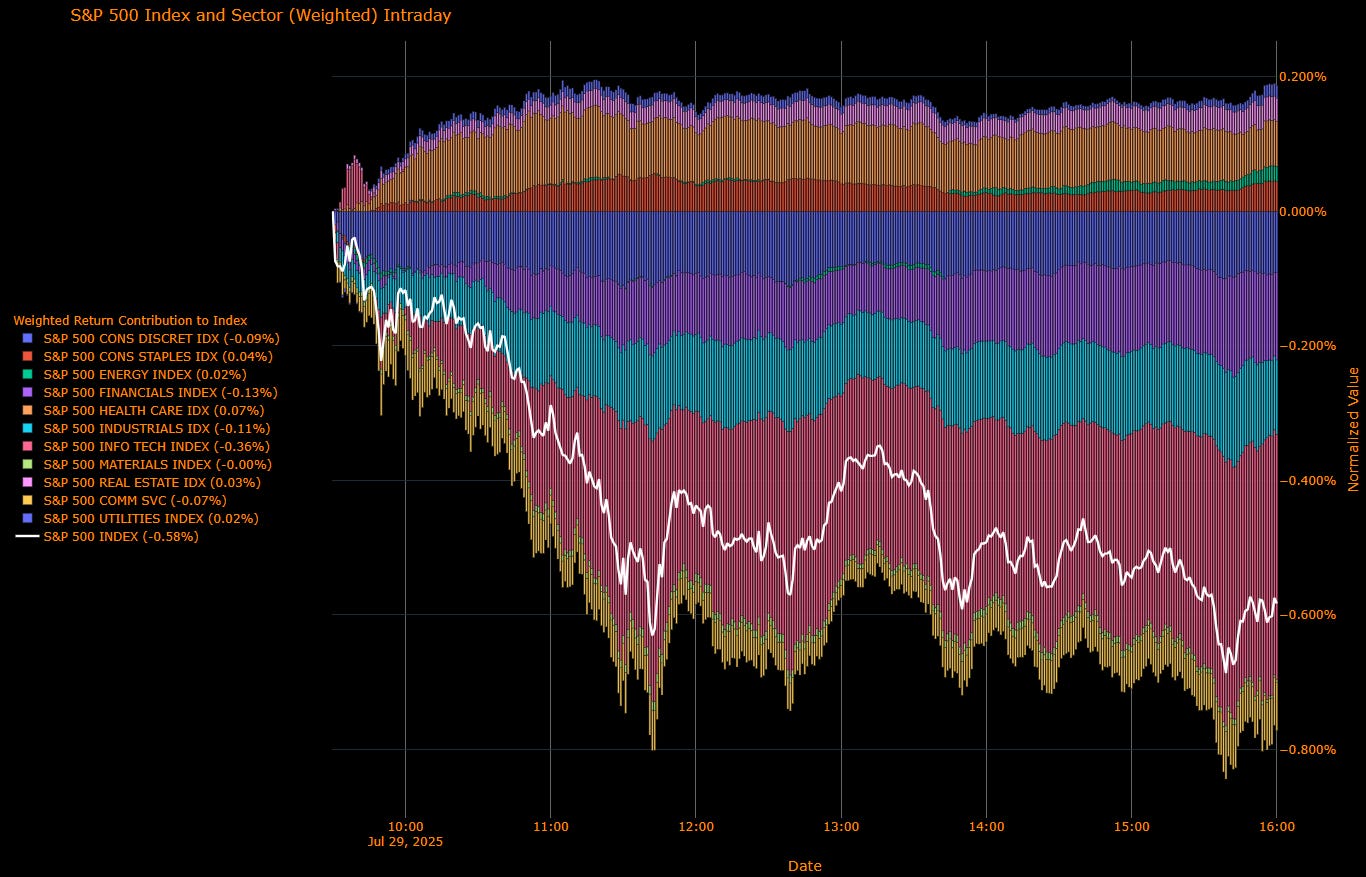

Sector Contribution Breakdown

(Weighted Return Contribution to S&P 500)

Top Negative Contributors:

Info Tech (–0.36 pp) — Led the decline, with broad-based selling in semis and software as valuations became a focus ahead of key earnings.

Financials (–0.13 pp) — Underperformance driven by flattening pressure and liquidity rebalancing ahead of the Fed.

Industrials (–0.11 pp) — Machinery, freight, and aerospace pulled back on renewed tariff uncertainty and soft demand signals.

Consumer Discretionary (–0.09 pp) — Marginal drag led by retailers and autos, as rate sensitivity and cautious consumer commentary took their toll.

Comm Services (–0.07 pp) — Weighed by streaming and media names.

Health Care (–0.07 pp) — Broader underperformance, possibly linked to revived pharma tariff chatter.

Materials (–0.00 pp) — Flat, but fragile.

Marginal Positives:

Energy (+0.02 pp) — Modest gains on firmer oil, Russia sanctions speculation.

Utilities (+0.02 pp) — A surprising green spot despite rising yields.

Staples (+0.04 pp) — Held up marginally on rotation into low-vol names.

Real Estate (+0.03 pp) — A bounce, but insufficient to offset pressure from long-duration rates.

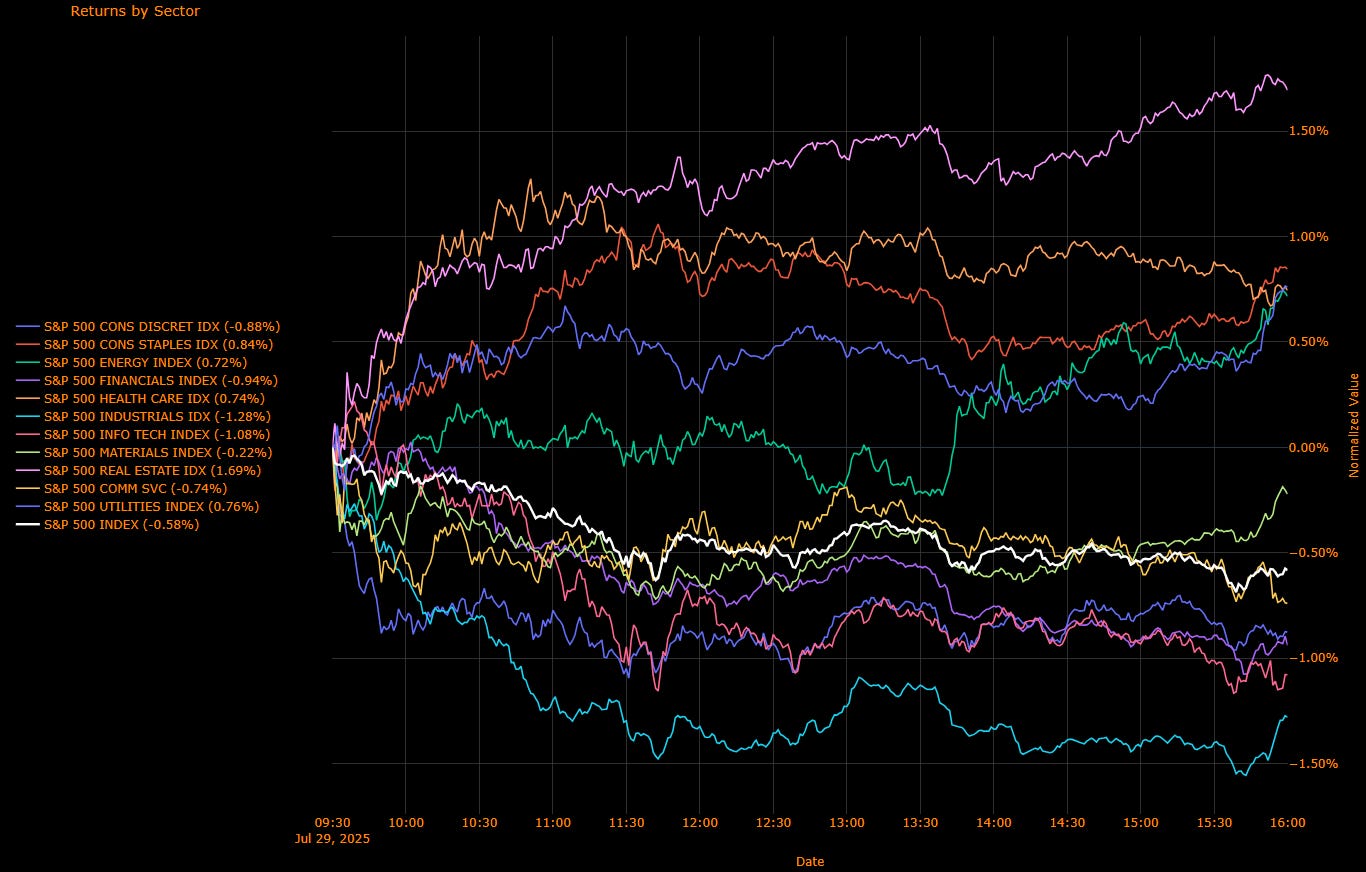

Sector Performance Breakdown

(Unweighted Daily Returns)

Strongest Sectors:

Real Estate (+1.69%) — Unexpected pop despite curve tension; possible positioning unwind.

Utilities (+0.76%)

Staples (+0.84%)

Energy (+0.72%)

Health Care (+0.74%)

Broad Decliners:

Industrials (–1.28%) — Weakest overall. Machinery, airlines, and logistics sank under growth concerns and tariff recalibration.

Info Tech (–1.08%) — Heavy reversal ahead of key earnings, with stretched multiples a growing concern.

Financials (–0.94%) — Curve flattening and QRA supply fears weighed on banks.

Comm Services (–0.74%) — Softness in streaming, advertising, and telecoms.

Consumer Discretionary (–0.88%)

Materials (–0.22%) — Outperformed other cyclicals, but unable to attract fresh flows.

Macro Overlay: Rotation Breaks, Risk Management Creeps In

Markets came into Tuesday pricing in macro clarity but left with renewed confusion. On the surface, a 0.58% S&P decline doesn’t scream panic. But dig into the tape, and signs of stress multiply.

Despite bond yields falling (30-year yield down 10 bps), duration proxies like Tech and Financials stumbled, a rare signal that positioning fatigue is overtaking any fundamental rate story. With valuations stretched and Powell’s credibility under the microscope, the usual playbook of "buy duration, hedge beta" isn’t holding up.

The collapse in Tech and Financials coincided with fresh ambiguity from tariff talks. Bessent confirmed that no extension is guaranteed, and while the mood was "constructive," Beijing appears to have prematurely floated a 90-day pause. This leaves traders exposed heading into both the Fed decision, QRA, and earnings from Big Tech… all within a 48-hour window.

Fragility Is the New Narrative

Breadth has cracked. Sector leadership is thin. Rate-sensitive names are no longer a safe haven. And with Tech earnings, Fed communication, and trade negotiations all colliding midweek, risk management has re-entered the narrative.

Markets still hope for a “constructive” path forward be it through tariff extensions, Fed flexibility, or strong earnings. But as of today, the burden of proof has shifted back to the data and the policymakers. This isn't panic, but it's no longer a market willing to blindly buy the dip either.

The rally needs a reset. And this week may decide whether that’s a pause... or a pivot.

US IG Credit Wrap: Spreads Inch Wider to 50.93 bp as Macro Tension Tightens and Market Resilience Wobbles

Current IG Spread: 50.93 bp | 5-Year Avg: 62.72 bp | COVID High: 151.80 bp | Cycle Low: 43.75 bp

Investment-grade spreads ticked modestly wider to 50.93 bp on Tuesday, a subtle move that belies the mounting stress under the surface. While still historically tight, credit markets are beginning to show signs of strain not through dramatic repricing, but through hesitation. The context has shifted: we are now watching for cracks in the floor rather than breakouts above the ceiling.

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Macro Overlay: Quiet Tape, Loud Backdrop

Tariff Truce in Name Only

The US-China tariff truce remains “under discussion,” but investor enthusiasm has faded. Despite Bessent’s Stockholm optimism, there’s still no firm agreement, and skepticism is rising. Auto, tech, and industrial supply chains remain exposed, and corporate C-suites are bracing for another round of front-loading orders and pricing volatility. For now, credit has shrugged. But as tariff mechanics tighten particularly around EU, Japan, and Russia policy it’s hard to see how IG spreads can hold their line without consequence.

Long-End Rally Masks Duration Fragility

Tuesday’s 30-year yield dropped 10 bps after a strong auction, but this reprieve may be transitory. Duration-heavy issuers are watching the QRA signal closely if Treasury extends issuance out the curve, the IG space will have to reprice yield risk. The fact that spreads have not yet responded to the recent rally in rates implies misalignment rather than resilience.

Fed Chair Risk Now More than Just Dovish/Hawkish

All eyes are on Powell’s presser. Not for incremental guidance, but for cohesion. The potential for dissent within the FOMC is real, and Powell’s independence is now openly in question. This introduces a risk premium for credit investors who depend on steady, predictable forward guidance to manage reinvestment and portfolio convexity. One wrong word from Powell, or a hint of internal Fed division, and credit could be repriced from the belly out.

Capex Cracks Becoming Visible

Durable goods orders are fading, and guidance across industrials and capital goods sectors is softening. The tariff overhang is clearly suppressing investment decisions and that will bleed into earnings power. For IG issuers who rely on investment-grade credit status for funding certainty, this backdrop is dangerous. As cash flows come under pressure, spreads could face repricing not due to systemic fears, but simple balance sheet deterioration.

This Is Still a Tight Market… But It’s No Longer a Safe One

Spreads remain range-bound but conviction is thinning. The macro edge of this credit tape has become razor sharp:

A Fed that could pivot or fracture.

A Treasury that might extend the curve or surprise with short-term refinancing.

A White House pushing ahead with tariffs and reshaping global trade linkages in real time.

And yet… IG credit trades like we’re still in a pre-pandemic glidepath.

This is not a call for panic. But it's a moment to recognize that we're no longer in the “carry comfort zone.” We’re now in the credit fracture zone where spreads may not widen gradually… but suddenly.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

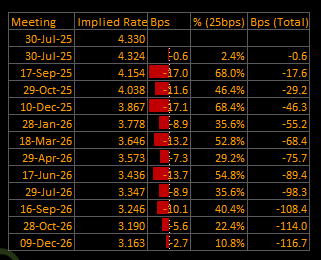

Short-End Rates Wrap: Easing Expectations Edge Deeper to –116.7 bp as Market Awaits Powell and Tariff Detail

Cumulative Implied Easing (to Dec 2026): –116.7 bp

Terminal Rate (Dec 2026): 3.163%

September OIS Cut Probability: 68.0% | Implied Rate: 4.154%

The short-end continues to lean dovish, with the total implied rate cuts expanding to –116.7 bp, up from –107.3 bp just a day ago. Traders are now pricing nearly five full cuts between now and the end of 2026, with a 68% chance of easing by September. What looked like a plateau in rate expectations has quietly become a slide slow, but firm as macro risks accumulate and confidence in the soft landing narrative begins to fray.

OIS-Implied Policy Path

Macro Overlay: Erosion Beneath the Calm

September Becomes the New Baseline

A 68% cut probability for September isn’t aggressive it’s consensus. The market has moved from “maybe September” to “probably September, unless Powell blocks it.” That makes this week’s Fed press conference critical. Powell doesn't need to guide a cut. He just needs to leave the door open. A nod to capex weakness, slower job openings, or tariff spillovers could lock in market conviction. But a hawkish lean even rhetorically could flatten this curve fast.

The Tariff Truce Is Already in the Price

The curve assumes that tariff escalation is managed or at least staged. The US–EU deal, Canada negotiations, and “optimistic” noises out of Stockholm all help. But this isn’t a market pricing in tail risk. It’s pricing in soft-landing diplomacy. If that diplomacy breaks or if supply chain shifts trigger cost-push pressure front-end repricing will be fast. There are over 200 tariff action notices due by week’s end. The risk is back-loaded.

Front-End Rally vs. Fed Optics

Yields across the curve fell Tuesday, led by a strong 30-year auction, but the short end remains most sensitive to perceived Fed coherence. With rising dissent risk and mounting political pressure, Powell’s tone could determine not just September, but whether the curve resets back toward 90 bp or firms above –120 bp. The Fed may want optionality but the market wants direction.

Capex, Labor, and the Fade in Soft-Landing Optimism

Job openings fell again. Durable goods orders remain soft. And surveys across small business and manufacturing show hesitation, not expansion. The market sees this not as a collapse, but a slow bleed in economic activity that reinforces the case for gradual cuts. Every macro print now reinforces this drift not dramatic, but steady that keeps the easing glidepath intact.

It’s No Longer a Pause… It’s a Descent

The OIS curve has stopped treading water. It’s now drifting lower again, with implied rates pulling down toward levels last seen during early soft-landing pricing in late 2023. But this descent isn’t steep it’s structured. The market is telling us:

September is a likely start.

2026 ends near 3.16%.

Easing will be persistent, not panicked.

But that path is priced on hope: that Powell stays patient, that tariffs are managed, and that growth cools but doesn’t crack.

The next 48 hours Powell’s language, the tone of the QRA, and the scale of tariff newsflow will either lock in this glidepath… or fracture it.

Tactical Portfolio

Morning Trade(s) and Market thread

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.