Macro Regime Tracker: PPI and Inflation Risk

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

We saw the PPI print come in above expectations today, which falls directly in line with the views I have been laying out.

MAIN IDEA: INFLATION RISK IS GREATER THAN RECESSION RISK.

I recorded a livestream today that explains this dynamic further:

We saw bonds down on the day as equities exhibited some selling pressure. ES and NQ mean-reverted back up into the close as the Russell and Bitcoin ended the day in the red. If you are trying to understand more about how positioning functions through catalysts like this, I would encourage you to review all the Macro Alpha Primers here:

Macro Alpha Primers:

Macro Alpha Primer: Credit Risk and Duration Risk and Macro Podcast: Macro Alpha Primer

Macro Alpha Primer: Correlations and Macro Podcast: Macro Alpha Primer

Macro Alpha Primer: Macro Catalysts, Hedging Pressure, and Positioning and Macro Podcast: Macro Alpha Primer

Macro Alpha Primer: Positioning Premiums and Macro Podcast: Macro Alpha Primer

My view is equities remain skewed to the upside. Bitcoin and the Russell outperformed ES earlier this week, so an underperformance today is not surprising. I laid out the logic and levels for ES at the end of this report for paid subscribers, if you want to review it:

A NOTE ON BITCOIN:

Bitcoin underperformed ES and expanded its short-term range within the hourly timeframe. If Bitcoin has a significant move up OR down relative to the timeframe we are looking at, you need to expect a commensurate period of time to take place before mean reversion. In other words, if I have a view on the specific driver of the selling pressure is going to mean-revert immediately, then I could have bought the low today (I didn’t). However, since it is deviating from ES in its underperformance, I would want to wait until I see it begin outperforming ES AND allow time for consolidation to occur. The underlying principle here is that time and price go hand in hand. Connect information with this, and you can have an edge in markets.

If none of that makes sense, I believe Bitcoin will move higher from here and stay above 115k. If it doesn’t, this could be a sign of further selling pressure depending on some other factors as well.

As always, all of the systematic models are updated below. I would encourage everyone to review all the playbooks I put in this report (they are 100% free).

Main Developments In Macro

US Macro & Fed

*US MONEY-MARKET FUND ASSETS HIT RECORD $7.19 TRILLION AT ICI

*MORTGAGE RATES SLIP TO 6.58%, LOWEST SINCE OCTOBER

*EIA SAYS US NATURAL-GAS STOCKPILES ROSE 56 BCF LAST WEEK

*BARKIN: SEEING DEMOGRAPHIC CLIFF AS BABY BOOMERS EXIT WORKFORCE

*BARKIN: ORIGINAL JOBS DATA WERE MORE SURPRISING THAN REVISIONS

*BARKIN: UNEMPLOYMENT AT 4.2% IS NOT A BAD NUMBER

*BARKIN: MANUFACTURERS ARE ALL STRUGGLING WITH MARGIN PRESSURES

*FED'S BARKIN: GETTING SMELL OF STRONGER JULY ON CONSUMER SIDE

*FED'S BARKIN: BUSINESSES AREN'T YET PREPPING FOR LAYOFFS

*FED'S BARKIN: WE'RE NOT SEEING FOG LIFT ON THE HIRING SIDE

*RICHMOND FED PRESIDENT TOM BARKIN SPEAKS IN VIRTUAL EVENT

*MUSALEM: SO FAR, MUTED TARIFF IMPACT ON CORE GOODS AND SERVICES

*MUSALEM: INFLATION COULD BE PERSISTENT, BUT NOT MY BASE CASE

*MUSALEM: REASONABLE TO EXPECT PAYROLL BREAKEVEN RATE BELOW 50K

*MUSALEM: DEMAND FOR LABOR HAS DECLINED BUT SO HAS SUPPLY

*MUSALEM: LABOR MARKET AT FULL EMPLOYMENT BUT RISKS TO DOWNSIDE

*MUSALEM: EXPECT TARIFF INFLATION IMPACT TO FADE IN 2-3 QUARTERS

US Policy: White House / Trade / Tariffs / Treasury

*NAVARRO ON PPI REPORT: LET'S SEE WHAT HAPPENS, WATCH THE DATA

*NAVARRO: HEAVY FOCUS OF TARIFFS WILL BE GENERIC PHARMA PRODUCTS

*NAVARRO SPEAKS TO REPORTERS AT THE WHITE HOUSE

*NAVARRO ENDS REMARKS ON CNBC

*NAVARRO: EXPORT CONTROLS BY CHINA, RUSSIA COULD HURT US

*WHITE HOUSE TRADE ADVISER PETER NAVARRO SPEAKS ON CNBC

*NAVARRO: PHARMA TARIFFS WILL LIKELY BE UNDER SECTION 232

*TRUMP: CHINA HAS BATTERIES, WE HAVE OIL AND GAS

*TRUMP: WE'RE WAY AHEAD OF CHINA IN TERMS OF CHIPS

*TRUMP: CHINESE EVS AREN'T COMING IN TO US BECAUSE OF TARIFFS

*TRUMP PRAISES NVIDIA BLACKWELL CHIP

*BESSENT: US SEEKS ‘BUDGET-NEUTRAL’ WAYS TO ACQUIRE MORE BITCOIN

*BESSENT: BITCOIN FORFEITED TO US TO SERVE AS STRATEGIC RESERVE

*BESSENT: GOING TO STOP SELLING BITCOIN HOLDINGS

*BESSENT: BITCOIN RESERVES ARE WORTH AROUND $15B, $20B

*BESSENT: GOING TO RETAIN GOLD AS A STORE OF VALUE

*BESSENT: 'WATCH THIS SPACE' ON PHARMACEUTICAL TARIFFS

*BESSENT: CHINA BACKED SELVES INTO CORNER ON CHIPS

*BESSENT, ASKED ON NVIDIA, AMD DEALS, SAYS THEY ARE SPECIAL COS.

*BESSENT: TARIFFS ALONE CAN TAKE DEFICIT RATIO INTO 5% RANGE

*BESSENT: AUG., SEPT. WILL BE GOOD TEST OF TARIFF REVENUE

*BESSENT: TRUMP-PUTIN TALKS ARE 'PRECURSOR' FOR A SECOND ROUND

*BESSENT: TRUMP WILLING TO KEEP TALKS GOING WITH PUTIN

*BESSENT: DON'T KNOW IF PUTIN WILL AGREE TO A CEASE-FIRE

*BESSENT: REPEATS, TIME FOR EU TO PUT UP OR SHUT UP ON RUSSIA

US Politics / Oversight

*WARREN WRITES LETTER TO CANTOR FITZGERALD CEO BRANDON LUTNICK

*WARREN PROBES LUTNICK'S SON, SUSPECTING PROFIT FROM TARIFF BETS

*TRUMP ENDS REMARKS AT THE WHITE HOUSE

*TRUMP SPEAKS ON BRIAN KILMEADE RADIO SHOW

International & Geopolitics

*TRUMP: WILL KNOW WHETHER PUTIN MEETING IS GOOD VERY QUICKLY

*TRUMP: WANT SECOND MEETING TO HAPPEN IN ALASKA

*TRUMP: WANT SECOND MEETING TO HAPPEN VERY SHORTLY AFTER

*TRUMP: TOMORROW JUST WANT TO SET TABLE FOR NEXT MEETING

*TRUMP: REDUCING NATO TROOPS HAS NOT BEEN 'PUT BEFORE ME'

*TRUMP: PUTIN WOULD LIKE TO SEE A DEAL

*TRUMP: RARE EARTH VERY UNIMPORTANT RELATIVE TO THIS

*TRUMP: THINK PUTIN WILL MAKE PEACE

*TRUMP DEMURS WHEN ASKED ABOUT OFFERING RARE MINERALS TO PUTIN

*TRUMP ON BORDER: MEXICO, CANADA DO WHAT WE TELL THEM TO DO

*TRUMP: THIS PUTIN MEETING SETS UP SECOND MEETING

*TRUMP: THERE'S A 25% CHANCE MEETING IS A FAILURE

*TRUMP: WILL HOLD PRESS CONFERENCE, BUT NOT SURE IF JOINT

*TRUMP: IF PUTIN MEETING IS BAD I WON'T BE CALLING ANYONE

*TRUMP: WILL CALL ZELENSKIY IF IT'S A GOOD MEETING WITH PUTIN

*TRUMP: PUTIN IS CONVINCED HE'S GOING TO MAKE A DEAL

*KREMLIN SAYS NO PLANS TO SIGN DOCUMENTS AT RUSSIA-US TALKS: IFX

*KREMLIN: RUSSIA-US COOPERATION HAS HUGE UNTAPPED POTENTIAL: IFX

*KREMLIN SAYS RUSSIA-US TALKS TO START AT 11.30AM LOCAL TIME:IFX

*KREMLIN: PUTIN AND TRUMP TO DISCUSS ECONOMIC COOPERATION: TASS

*USHAKOV: CENTRAL TOPIC OF TALKS WILL BE WAR IN UKRAINE: IFX

*KREMLIN SAYS PUTIN, TRUMP TO GIVE JOINT PRESS BRIEFING: TASS

*RUSSIA SAYS AGENDA FO SUMMIT HAS BEEN AGREED: IFX

*PUTIN: NEW ARMS AGREEMENTS WITH US ARE POSSIBLE: IFX

*PUTIN HELD MEETING W/RUSSIAN TOP OFFICIAL AHEAD OF US TALKS:RIA

*RUSSIA MAY EXTEND GASOLINE EXPORT BAN THROUGH SEPT.: IFX

*EU HOPES TO REACH FINAL TEXT ON JOINT TRADE STATEMENT SOON

*EU HAS RECEIVED TEXT FROM US ON TRADE JOINT STATEMENT

*INDIA OFFICIAL: TO KNOW AUG-END HOW NEXT US TALKS TO TAKE PLACE

*INDIA COMMERCE SECY: FULLY ENGAGED WITH US ON TRADE NEGOTIATION

*INDIA FAST TRACKING TRADE TALKS WITH EU: COMMERCE SECRETARY

*LULA: WON'T CRY BECAUSE US STOPPED BUYING BRAZILIAN GOODS

*LULA: SOCIAL MEDIA REGULATION PROPOSAL FINALIZED YESTERDAY

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

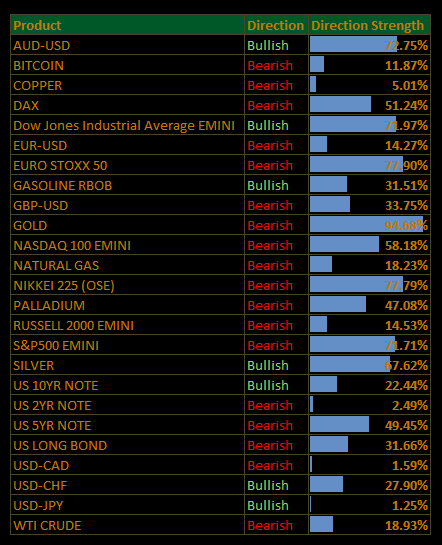

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

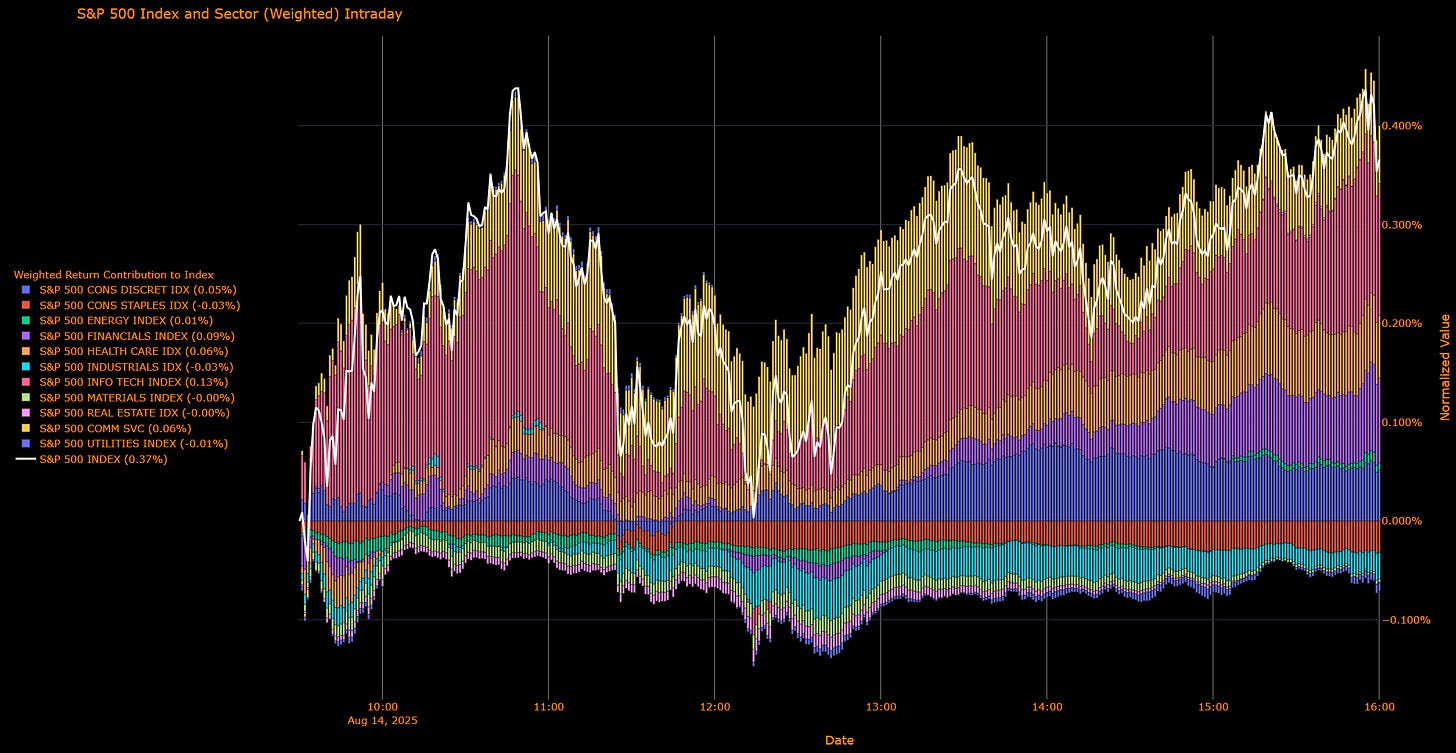

US Market Wrap: Tech, Financials, Health Care Lead; Defensives Drag as PPI Pops Yields

The S&P 500 rose 0.37%, but the tape was narrow: yields climbed after a hotter PPI, trimming the odds of a larger September cut while leaving a quarter-point move as the base case. The dollar firmed; crude gained; gold slipped. Two-year Treasuries +6 bps to 3.73%, tens +5 bps to 4.29% as traders marked down 50 bp talk and penciled in a more “less dovish” path.

Sector Contribution Breakdown

(Weighted return contribution to S&P 500)

Info Tech (+0.13 pp) — mega-caps steadied; chip headlines (Intel/NVIDIA) helped.

Financials (+0.09 pp) — higher long rates and firmer curve optics aided banks.

Health Care (+0.06 pp) — broad advance across pharma/managed care.

Communication Services (+0.06 pp) — platforms and media firmed.

Consumer Discretionary (+0.05 pp) — travel/auto strength.

Energy (+0.01 pp) — crude bounce provided a tailwind.

Drags: Consumer Staples (–0.03 pp), Industrials (–0.03 pp), Utilities (–0.01 pp); Materials/Real Estate ~0.00 pp.

Sector Performance Breakdown

(Unweighted daily returns)

Leaders: Health Care (+0.71%), Financials (+0.63%), Communication Services (+0.59%), Consumer Discretionary (+0.49%), Info Tech (+0.39%), Energy (+0.25%).

Laggards: Consumer Staples (–0.60%), Utilities (–0.34%), Industrials (–0.32%), Materials (–0.17%), Real Estate (–0.04%).

Macro Overlay: PPI Surprise, “Less Dovish” Stance

Wholesale inflation: PPI +0.9% m/m, +3.3% y/y—strongest monthly gain in three years; services +1.1%. Tariff pass-through risk moved up the agenda.

Policy expectations: Markets still lean to a September 25 bp cut (odds ~mid-80s) while 50 bp looks off the table absent a growth shock.

Fedspeak: Bessent clarified his “neutral ~150 bp lower” comment (not prescribing cuts); Musalem says it’s too early and a 50 bp move isn’t warranted; Barkin sees a “stronger July” on the consumer side.

Cross-asset: Dollar firm; WTI ~+$2.2% to $64; gold –0.5%.

Final Word

Breadth was soft versus the cap-weighted print classic late-day index resilience driven by Tech/Financials/Health Care while defensives bled on higher yields. With PPI re-heating and retail sales/consumer sentiment up next, the base case remains a September 25 bp cut with a hawkish tone. Into that setup, favor quality growth with pricing power and rate-beta pockets (banks) while fading defensive duration proxies (Staples/Utilities) on yield pops.

US IG Credit Wrap: Spreads Hold ~50 bp as PPI Jars Rates, Not Credit

IG OAS: 49.96 bp • 5-yr avg: 62.65 bp • Cycle low: 43.75 bp • COVID high: 151.80 bp

Rates: 2y +6 bp to 3.73% • 10y +5 bp to 4.29% • Dollar firmer • Equities mixed

Investment-grade spreads were essentially unchanged to +0.24 bp on the day at ~50 bp, weathering a hotter PPI (+0.9% m/m, +3.3% y/y; services +1.1%) that pushed Treasury yields higher and clipped the market’s appetite for a larger September cut. Credit beta stayed calm: IG remains ~6 bp off cycle tights and ~13 bp inside its 5-year average, keeping the carry/richness debate front and center.

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Macro Overlay for IG

Policy: Markets lean to a September 25 bp cut with a “less dovish” tone; odds of 50 bp have faded after the PPI surprise. Bessent clarified he’s citing neutral-rate models (~150 bp lower) rather than prescribing cuts; Musalem says a 50 bp move isn’t warranted; Barkin smells a firmer July consumer—Friday retail sales is the next test.

Rates & FX: The rates pop (2s/10s +6/+5 bp) dented total-return math but didn’t shake spread risk; a firmer dollar and stronger oil are noise for IG fundamentals near term.

Inflation & Earnings: Wholesale-price re-acceleration raises tariff pass-through risk into margins later this year, but with CPI still contained, the base case is gradual disinflation + modest easing, a mix that typically anchors IG OAS in the 45–60 bp channel.

Rates the Focus:

Rates did the heavy lifting; credit didn’t blink. Until growth or policy surprises force a repricing, carry over convexity remains the IG playbook with spreads anchored around 50 bp and risks skewed to rates, not OAS.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

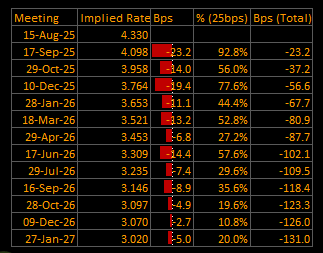

US Short-End Rates Wrap: September Cut Likely; Path Trims to –131 bp, Terminal ~3.02%

Cumulative Implied Easing (to Jan 2027): –131.0 bp

Terminal Rate (Jan 2027): 3.020%

September OIS Cut Probability: 92.4% — Implied Rate: 4.099% | Implied Move: –23.1 bp (~0.92×25)

The front end cheapened after the PPI surprise, nudging the path shallower versus yesterday. Markets still price a September cut, but the opener looks more like a “less dovish 25” than a 50. The glidepath now extends to a ~3.02% terminal by early 2027 (from ~2.97% yesterday).

OIS-Implied Policy Path

Macro Overlay: Hot PPI, Cooler Cut Odds

Inflation pulse: PPI +0.9% m/m, +3.3% y/y (services +1.1%) lifted 2y/10y yields +6/+5 bp, firmed the dollar, and knocked back the 50 bp tail.

Fedspeak: Bessent clarified he’s citing neutral-rate models (~150 bp lower) rather than prescribing cuts; Musalem says 50 bp isn’t warranted; Barkin sees a stronger July consumer.

Next catalysts: Retail Sales and consumer sentiment strong prints would keep the Fed on a “less dovish” track; soft prints reopen discussion of a faster glide.

Takeaway

The debate has shifted from “if” to “how dovish” the start is. After PPI, pricing favors a 25 bp September cut with a slower follow-through (2025 ~–57 bp, 1H26 ~–46 bp). Until growth weakens decisively, expect the market to hold the 3.0–3.1% terminal and lean toward shallower, data-contingent easing.

Tactical Portfolio

Morning Trade(s) and Market thread

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.