Macro Regime Tracker: Pre-FOMC

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

Hello everyone,

We are approaching FOMC week and I have updated all of the models since the close on Friday with HOW the macro changes are developing. If you are not a paid subscriber yet, this would be a great week to do a free trial (LINK) because we are at a key inflection point.

All of the major pieces for WHERE we are can be found here:

Liquidity Tides and Strategic Positioning in Bitcoin and Gold (IMPORTANT ONE)

The Credit Cycle Is Built on the Consumer—and Will End With Them

Main Developments In Macro

U.S. Macro, Fed, and Rates

TREASURY YIELDS RETREAT FROM DAY'S HIGHS, FLATTENING CURVE

US JULY KC FED SERVICES ACTIVITY -5

US PRELIM JUNE DURABLE GOODS EX-TRANS RISE 0.2% M/M; EST. +0.1%

US PRELIM JUNE DURABLE GOODS ORDERS FALL 9.3% M/M; EST. -10.7%

TRUMP: HAD GOOD MEETING WITH POWELL ON INTEREST RATES

TRUMP: POWELL TOLD ME ECONOMY IS DOING WELL

TRUMP: THINK POWELL WILL LOWER INTEREST RATES

TRUMP SAYS POWELL IS A 'VERY GOOD MAN': POOL

TRUMP TOUTS 'GREAT' ECONOMIC NUMBERS

DOLLAR GAINS AFTER TRUMP DOWNPLAYS POWELL DISPUTE: MACRO SQUAWK

Global Trade, Tariffs, and Currency Commentary

TRUMP: UK TRADE DEAL IS CONCLUDED

TRUMP: MORE OF A CELEBRATION OF UK DEAL THAN WORKING IT OUT

TRUMP: MEETING W/ EU, WOULD BE BIGGEST DEAL IF WE COULD MAKE IT

TRUMP: EU DEAL STICKING POINTS ARE MAYBE 20 THINGS

TRUMP: WE'LL SEE IF WE MAKE A DEAL WITH EU ON SUNDAY

TRUMP: WILL MEET WITH THE EU ON SUNDAY

TRUMP: EU HAS PRETTY GOOD CHANCE OF MAKING A DEAL

TRUMP: 50-50 CHANCE OF MAKING DEAL WITH EU

TRUMP: WILL TALK ABOUT UK TRADE DEAL ON THIS TRIP, MAY APPROVE

TRUMP: WILL HAVE MOST DEALS DONE BY AUGUST 1, IF NOT ALL

TRUMP: WE HAVE CONFINES OF DEAL WITH CHINA

TRUMP: NEARING TRADE DEAL WITH CHINA

TRUMP: WILL SEND CLOSE TO 200 TARIFF LETTERS

TRUMP: SOME LETTERS WILL SAY 10%, 15% TARIFF RATE

TRUMP: STEEL TARIFF: IF CUT FOR ONE, WILL HAVE TO DO FOR ALL

TRUMP: NOT A LOT OF ROOM TO REDUCE UK STEEL, ALUMINUM TARIFF

TRUMP SAYS MAY IMPOSE UNILATERAL TARIFF RATE ON CANADA

TRUMP: NOT A LOT OF NEGOTIATING WITH CANADA

TRUMP: LOWER DOLLAR MAKES THE TARIFFS WORTH MORE

TRUMP: EU MAY HAVE TO BUY DOWN THEIR TARIFFS

TRUMP: CHINA, JAPAN DOMINATED BECAUSE OF WEAK CURRENCIES

TRUMP: JAPAN WANTS TO HAVE A WEAK CURRENCY

TRUMP: ALL CHINA DOES IS FIGHT FOR A WEAK CURRENCY: POOL

TRUMP SAYS STILL WANTS STRONG DOLLAR: POOL

TRUMP SAYS WITH STRONG DOLLAR, CAN'T SELL ANYTHING: POOL

Geopolitics, Defense & Security

US CENTCOM COMMENTS ON SYRIA IN A STATEMENT

US FORCES KILL SENIOR ISIS LEADER IN AL-BAB, SYRIA

CENTCOM SAYS KILLED ISIS LEADER IN SYRIA

China Macro

XI SAYS CHINA ECONOMY CONTINUES TO IMPROVE STEADILY: CCTV

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

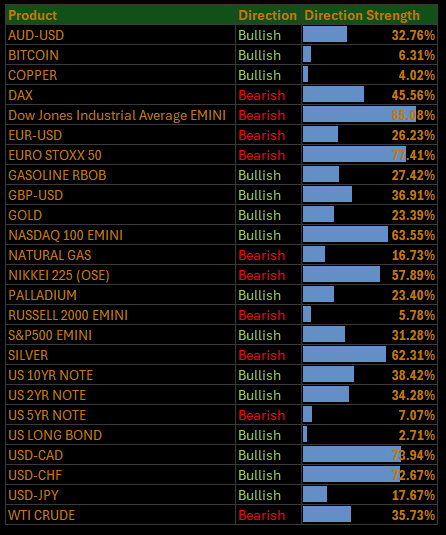

Here is a summary of all models and their directional strengths:

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

US Market Wrap: S&P 500 Climbs as Financials, Tech Lead; Rotation Deepens Ahead of Tariff Cliff

The S&P 500 rose 0.27% Friday, rebounding modestly as traders rotated back into cyclicals and leaned into sectors perceived as relatively insulated from the escalating tariff rhetoric. Underneath the surface, the rally was narrow and mechanical — led by Financials and Tech while defensive sectors continued to underperform. Macro uncertainty around capital investment and tariff execution loomed large, even as headline strength offered a thin layer of stability.

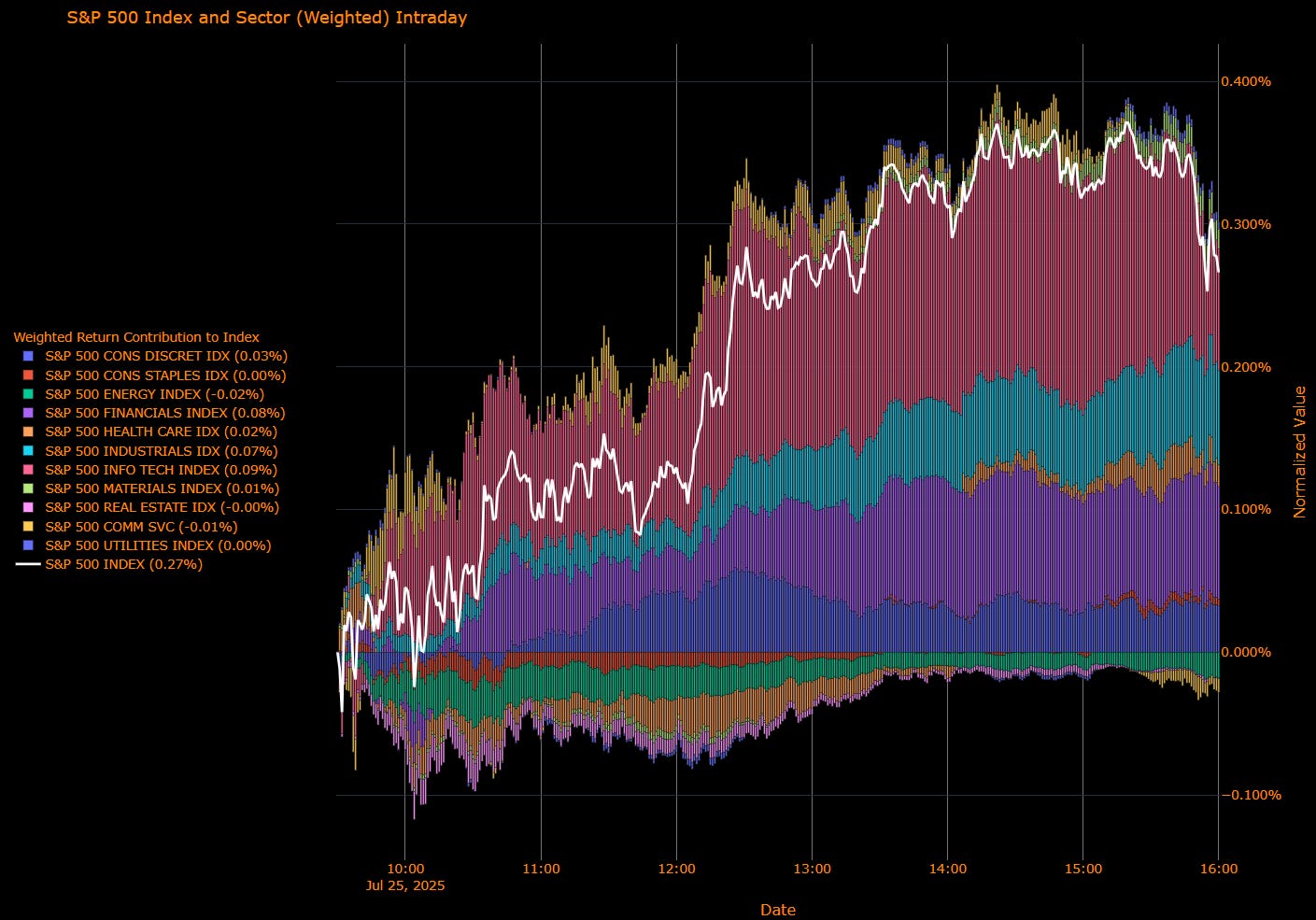

Sector Contribution Breakdown

(Weighted Return Contribution to S&P 500)

Info Tech (+0.09 pp) – Continued leadership from semis and AI infrastructure. Nvidia and chip suppliers lifted the space, offsetting weakness in software.

Financials (+0.08 pp) – Outperformed on firming yields and rotation into balance-sheet-sensitive cyclicals. Banks and insurers led.

Industrials (+0.07 pp) – Benefited from tariff optimism and strong PMI chatter. Machinery and logistics names extended gains.

Consumer Discretionary (+0.03 pp) – Modest boost from select retail and auto strength. Housing names were flat.

Health Care (+0.02 pp) – Marginal positive impact, driven by biotech and large-cap pharma recovery.

Materials (+0.01 pp) – Minor lift from metals and building products.

Energy (–0.02 pp) – Slight drag despite stable crude. E&Ps slipped, while refiners held in.

Comm Services (–0.01 pp) – Remained soft, with media names reversing early strength.

Utilities, Staples, Real Estate (Net zero) – No meaningful contribution; defensives remain out of favor.

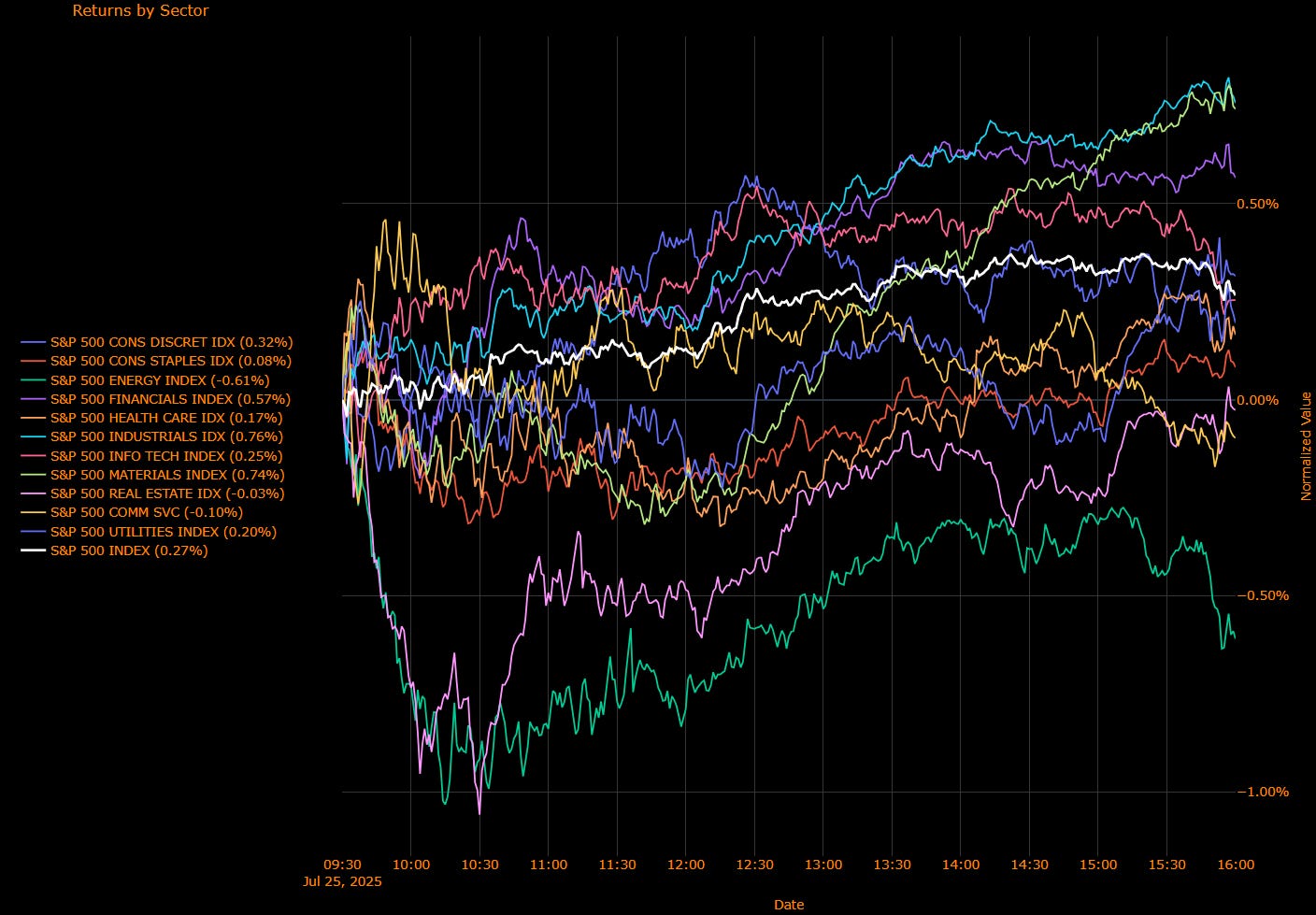

Sector Performance Breakdown

(Unweighted Daily Returns)

Industrials (+0.76%) – Top performer on the day. Robust PMI expectations and tariff deal hopes fueled broad-based strength.

Materials (+0.74%) – Surged on China optimism and tariff carve-out chatter. Chemicals and miners outperformed.

Financials (+0.57%) – Strong across the board, as curve steepening bets returned and capital market activity steadied.

Consumer Discretionary (+0.32%) – Healthy bounce led by retail and autos. Consumer confidence remains supportive.

Info Tech (+0.25%) – Steady bid for semis and infrastructure. Rotation continues to favor "picks-and-shovels" AI names.

Health Care (+0.17%) – Mixed performance. Biotech strength offset by large-cap managed care softness.

Utilities (+0.20%) – Slight recovery after yesterday's duration-driven pressure.

Staples (+0.08%) – Still lackluster, though off session lows. Food and beverages remain under scrutiny.

Comm Services (–0.10%) – Stabilized but remains fragile. Streamers and ad-tech continue to see outflows.

Real Estate (–0.03%) – Flat-to-negative, caught between rate headwinds and macro rotation.

Energy (–0.61%) – Lagged sharply. Crude softness and profit-taking drove E&P underperformance.

Macro Overlay: Trade Talks Waver, Investment Cools

Tariff Cliff Now in Sharp Focus

President Trump reiterated a 50-50 chance of reaching a deal with the EU before the August 1 deadline, but also threatened another 200 unilateral tariff letters, including provisions as high as 50% on sensitive categories like autos, copper, and semiconductors. The idea of a 15% baseline remains on the table, but Canada looks increasingly isolated and China’s role in Stockholm talks has become more tactical than transformational.

Markets are showing signs of fatigue not from noise, but from the creeping realization that tariff risk is real, escalating, and now being priced into corporate planning cycles.

Capex Cracks Widen

Fresh data showed core capital goods orders declined 0.7% in June, a sharp disappointment from expectations and a clear sign that policy uncertainty is impairing corporate investment. Durable goods orders slumped 9.3%, led by aircraft, but the weakness in underlying business equipment is more concerning.

Economists are warning that long-term planning is being disrupted not by demand, but by unclear cost structures tied to evolving tariff frameworks and unresolved tax debates. Small businesses are pulling back as margin pressures from imported inputs intensify.

Rotation Keeps the Index Afloat… But Risks Are Mounting

The market continues to climb, but breadth is suspect and macro risk is growing more acute. This is no longer a “soft landing” glidepath it's a balance between AI momentum, sector rotation, and faith that trade chaos doesn’t turn systemic. The S&P 500’s gain was built on cyclicals Financials, Industrials, and Materials but with Energy fading and defensives unable to catch a bid, there’s little ballast if policy disappoints.

The Fed may be on pause, but Trump’s tariff campaign is moving markets more directly than rate guidance. Tariffs are becoming the new policy lever, and they’re being wielded with increasing aggression. If no deals are inked by next week, expect repricing not just in cyclicals, but in earnings estimates and capital plans.

US IG Credit Wrap: Spreads Hover at 50.04 bp as Market Shrugs Off Macro Warnings

Current IG Spread: 50.04 bp | 5-Year Avg: 62.74 bp | COVID High: 151.80 bp | Cycle Low: 43.75 bp

Investment-grade credit continues to sit on a razor’s edge tight, stable, and seemingly immune to the noise. Spreads nudged marginally tighter to 50.04 bp, just above cycle lows and well inside the five-year average. It’s the kind of level that implies confidence… but increasingly, it looks like complacency. Macro risk is building, but IG paper isn’t blinking.

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Macro Overlay: A Dissonant Calm

Tariff Clock Still Ticking

Trump’s 15–50% tariff corridor remains in play. The market is pricing the EU deal as “likely,” but Trump called it “50-50, maybe less than that.” With over 200 new tariff letters expected in the coming days and sector-specific threats aimed at copper, semis, autos, and pharma, this is no longer just rhetoric. IG names in those sectors are directly exposed, yet spreads show no premium for that risk. Either deals get done, or credit reprices fast.

Capex Slips as Trade Noise Grows

Fresh data confirmed what many feared: business investment is cooling. Core capital goods orders fell 0.7%, missing expectations, while durable goods slumped 9.3%. Companies appear to be paring back spend as tariff uncertainty clouds margins and supply chain planning. Yet again, credit doesn’t care not yet. The implication: equity vol might show it first, but IG won’t stay immune.

Rates Up, Spreads Flat – For Now

The 10y yield tested 4.40% this week, and real rates continue to grind higher — but credit spreads remain glued to the floor. That’s a dangerous mismatch. If bond yields continue to rise without relief from rate cut pricing, LDI portfolios and real-money buyers could shift to the sidelines quickly. There’s no cushion at 50 bp. If duration pain returns, spreads will widen on the follow.

Fed Risk Shifts from Policy to Optics

The Fed’s renovation saga and Powell’s strained relationship with the Trump camp might seem trivial, but in tight credit markets, credibility is collateral. Powell is still in charge, but the institutional shield looks thinner. If political pressure accelerates or new leadership speculation emerges, expect duration spreads to widen on governance risk alone especially at the long end.

Tight, But Cracked Beneath the Surface

At 50.04 bp, IG spreads are whispering that nothing’s wrong that tariffs are bluster, capex weakness is noise, and Powell’s seat is secure. But the context is loud: core orders are down, the Fed is under pressure, yields are up, and tariffs are not hypothetical.

This is a market priced for the best-case outcome no policy mistake, no trade blowup, no credibility break. That may be fine for now. But spreads this low don’t bend they snap when assumptions fail. And with the August 1 deadline looming, there’s little room left for surprises.

The message: Credit is calm, but that calm is conditional. Keep your eyes on tariffs, rates, and the Fed’s political standing any one of them could break the spread floor beneath us.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

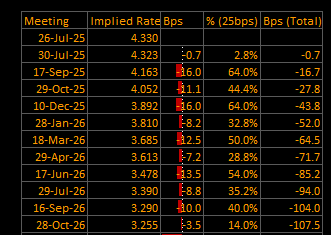

Short-End Rates Wrap: Cumulative Easing Widens to –107.5 bp as September Conviction Softens

Cumulative Implied Easing (to Oct 2026): –107.5 bp

Terminal Rate: 3.255% | September OIS Cut Probability: 64.0% | Implied Rate: 4.163%

The easing path remains priced but it’s no longer deepening. Friday’s OIS curve saw cumulative cuts retreat slightly to –107.5 bp from a recent high of –114.1 bp, while the terminal rate slid toward 3.255%. The September meeting still prices a cut with 64% probability, but momentum is flagging. Traders appear reluctant to push beyond the current glidepath without a clearer signal on growth, inflation, or the trajectory of Trump’s tariff campaign.

OIS-Implied Policy Path

Macro Overlay: Sticky Front-End, Softening Confidence

September Pivot Still “On,” But Not Locked

The market continues to assign a meaningful chance to a September cut, but the probability is stagnating near 64% just below a clean two-thirds pricing. That reflects both trader uncertainty and a lack of conviction in the macro narrative. With core capital goods orders unexpectedly declining and tariffs muddying the waters, there’s growing hesitation to bet on aggressive action unless Jackson Hole or July PCE delivers clarity.

Tariff Tail Risk Still Discounted

Trump’s comments suggesting a 50–50 shot at an EU deal paired with an explicit threat of 30–50% tariffs on laggards haven’t repriced the OIS curve much. That’s notable. With over 200 tariff letters expected and little movement from Canada or the UK, the risk premium remains curiously muted. Should headline escalation bleed into inflation prints or disrupt supply chains, the 2s5s complex could widen quickly but we’re not there yet.

Capex and Confidence Cracks Emerge

The 0.7% drop in core capital goods orders (vs. +0.1% est.) reinforced what survey data had already hinted at: investment is cooling. Small businesses report softening expenditure plans, and durable goods orders cratered 9.3%. Still, the market treats this as a growth plateau, not contraction and the curve stays glued to its easing channel, for now.

Fed Credibility Risk Creeps Back

Powell’s position remains intact, but the optics are deteriorating. Trump’s site visit and ongoing critiques of Fed waste and accountability are starting to feel less like theater and more like groundwork for a pivot. A shake-up isn’t priced. If that changes — especially around the November window forward guidance could lose its anchor. For now, the curve still trusts the Fed. But trust isn’t infinite.

Repricing Deferred, But Not Cancelled

With the terminal rate grinding lower and implied cuts holding near –108 bp, the market is leaning into the soft landing but it’s no longer accelerating the bet. Confidence in a September pivot is present but conditional. The bar for validation is rising.

OIS traders remain positioned for clean disinflation, tariff containment, and a smooth Fed glidepath. But none of that is guaranteed. With political risk rising, investment data turning, and tariff headlines heating up, the curve feels one jolt away from recalibration.

Tactical Portfolio

Morning Trade(s) and Market thread

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.