Macro Regime Tracker: The risks in macro

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

Today I recorded a spaces on Twitter where I covered some of the top questions people have about how the macro regime is developing. You can find the recording here: LINK

I also recorded a video explaining how the Fed fits into various stock bond correlation regimes: (the connected report is here: LINK)

Most Recent Macro Research:

All of the major pieces for WHERE we are can be found here:

Liquidity Tides and Strategic Positioning in Bitcoin and Gold (IMPORTANT ONE)

The Credit Cycle Is Built on the Consumer—and Will End With Them

And I have updated all of the models and strategies below. If you are a paid subscriber, keep a close eye on the chat as we move into FOMC this week.

Main Developments In Macro

US Fiscal Policy & Treasury Issuance

TREASURY SAYS BORROWING EST. JUMP MAINLY DUE TO CASH BALANCE

US TWO-YEAR NOTES DRAW 3.920%; ALLOTTED AT HIGH 58.43%

US AWARDS 55.3% OF TWO-YEAR NOTES TO INDIRECT BIDDERS

US AWARDS 34.4% OF TWO-YEAR NOTES TO DIRECT BIDDERS

US TWO-YEAR NOTES BID/COVER RATIO 2.62 VS. 2.58 PREVIOUS AUCTION

TREASURY WI 2Y YIELD 3.925% BEFORE $69 BILLION AUCTION

Monetary Policy & Fed Watch

TRUMP ASKED IF FED SHOULD CUT RATE THIS WEEK: I THINK IT HAS TO

TRUMP REITERATES HE WANTS LOWER INTEREST RATES

US JULY DALLAS FED MANUFACTURING INDEX 0.9; EST. -9.0

US Trade Policy & Tariffs

TRUMP: THINKING ABOUT TARIFF RANGE OF 15%-20% FOR OTHER NATIONS

TRUMP: WILL BE SETTING TARIFF FOR 'THE REST OF THE WORLD'

TRUMP: WILL ANNOUNCE PHARMA TARIFFS SOON

TRUMP: WILL DO SECONDARY SANCTIONS ON RUSSIA UNLESS DEAL MADE

TRUMP TOUTS RUSSIAN RARE EARTHS AS POTENTIAL TRADE PRODUCT

CHINA, US START TRADE TALKS IN STOCKHOLM

US FREEZES EXPORT CONTROLS TO SECURE TRADE DEAL WITH CHINA: FT

CARNEY SAYS TRADE NEGOTIATIONS WITH US AT 'INTENSE PHASE'

CHILE WON'T RETALIATE US TARIFFS, FINANCE MINISTER SAYS: EMOL

CORRECT: CHILE'S MARCEL HOPES FOR COPPER TARIFF EXCEPTION: EMOL

EU–US Trade Deal Headlines

EU TO BUY US MILITARY EQUIPMENT IN TRADE DEAL: WHITE HOUSE

EU PLEDGES NO ELECTRONIC TRANSMISSION TAX IN DEAL: WHITE HOUSE

WHITE HOUSE'S RAPID RESPONSE X ACCOUNT POSTS EU DEAL DETAILS

EU'S $600B US INVESTMENT TO COME FROM PRIVATE SECTOR: POLITICO

SEFCOVIC: STRATEGIC COOPERATION WITH US BETTER THAN TRADE WAR

SEFCOVIC: STRATEGIC US AI CHIP PURCHASES PART OF TRADE DEAL

EU'S SEFCOVIC: DEAL WITH US IS OPENING OF PROCESS

EU'S SEFCOVIC: 0% EU-US TARIFF LIST REMAINS OPEN TO ADDITIONS

SEFCOVIC: BELIEVE US PURCHASE NUMBERS IN TRADE DEAL ACHIEVABLE

US–Russia Tensions

TRUMP: WILL MAKE NEW DEADLINE TO RUSSIA

TRUMP: WILL MAKE NEW DEADLINE OF 10–12 DAYS TO RUSSIA

TRUMP: WILL ANNOUNCE NEW RUSSIA DEADLINE TONIGHT OR TOMORROW

TRUMP ON PUTIN: I'M NOT SO INTERESTED IN TALKING ANYMORE

TRUMP: ENVISIONED A LOT OF TRADE WITH RUSSIA

TRUMP SAYS HE WILL REDUCE 50 DAY DEADLINE HE HAD FOR PUTIN

Middle East Macro/Geo

TRUMP CITES IRAN FOREIGN MINISTER INTERVIEWS

TRUMP: IRAN SENDING OUT 'BAD SIGNALS'

NETANYAHU AND PUTIN DISCUSSED IRAN

KREMLIN: PUTIN SPOKE TO NETANYAHU ABOUT TENSIONS IN MIDDLE EAST

Industrial & Inflation Inputs

TRUMP: WILL BE DEALING WITH UK ON PHARMA

TRUMP: WE WANT TO BE MAKING PHARMA OURSELVES

TRUMP: WILL ANNOUNCE PHARMA TARIFFS SOON

TRUMP: ENVISIONED A LOT OF TRADE WITH RUSSIA

CHILE WON'T RETALIATE US TARIFFS, FINANCE MINISTER SAYS: EMOL

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

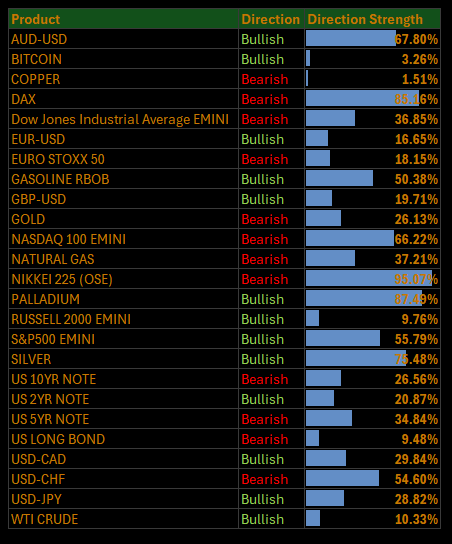

Here is a summary of all models and their directional strengths:

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

US Market Wrap: S&P Slips as Defensives Collapse, Tech and Energy Outperform… Breadth Turns Heavier into Fed and Tariff Pivots

The S&P 500 closed down 0.15% Monday in a session defined by sharp defensive underperformance and a market leaning more cautiously into the week’s macro gauntlet. Under the hood, the selloff was deceptively uneven: Tech and Energy rose, while Real Estate, Utilities, and Materials led a broad decline in rate-sensitive and tariff-exposed names. With investors front-running the Fed, the QRA, and a loaded week of earnings, the rotation turned sour beneath the surface.

Sector Contribution Breakdown

(Weighted Return Contribution to S&P 500)

Info Tech (+0.14 pp) – Led the tape again, with semiconductors and AI hardware firms benefiting from stabilized supply chain sentiment and tariff carve-out hopes.

Energy (+0.01 pp) – Marginal support as oil rebounded on China tariff negotiation tailwinds and US-Russia supply squeeze rhetoric.

Consumer Discretionary (+0.01 pp) – Flat to slightly positive, supported by reopening trades and some continued resilience in auto and travel sub-sectors.

Negative Contributors:

Financials (–0.08 pp) – Underperformed amid curve flattening and renewed focus on Powell’s press conference risks.

Health Care (–0.06 pp) – Hit by uncertainty over Trump’s pharma tariff threats and drag from large-cap managed care.

Industrials (–0.03 pp) – Soft PMI tone and tariff-exposed machinery names dragged.

Staples, Real Estate (–0.03 pp) – Broad selling in bond proxy names.

Comm Services (–0.04 pp) – Media and ad-tech names weakened into regulatory risk headlines.

Materials, Utilities (–0.02 pp each) – Materials fell on EU tariff deal disappointment; Utilities sold as bond yields edged up.

Sector Performance Breakdown

(Unweighted Daily Returns)

Energy (+0.45%) – Best-performing sector, helped by firmer crude and lower US inventory chatter. Renewed optimism around China demand supported refiners and upstream.

Info Tech (+0.41%) – Strong showing led by chipmakers and software platforms. Nvidia and second-tier AI names continued to attract momentum inflows.

Consumer Discretionary (+0.07%) – Modest rise led by autos and entertainment, though housing names lagged.

Broad Decliners:

Financials (–0.61%) – Curve pressure weighed heavily, particularly on banks and insurers. Capital markets revenue concerns also lingered.

Health Care (–0.66%) – Pharma names came under pressure as tariff rhetoric heated up; biotech offered little support.

Industrials (–0.33%) – Tariff headlines spooked capital goods and construction names; logistics was flat.

Materials (–0.88%) – Weakest link among cyclicals. EU deal fallout raised concerns about cost absorption across chemicals and packaging.

Real Estate (–1.41%), Utilities (–0.97%), Staples (–0.53%) – Heaviest pressure on duration-sensitive sectors as Treasury yields nudged higher. Traders appear to be lightening up ahead of Powell’s remarks and upcoming supply.

Macro Overlay:

Tariff Reality Bites, Defensive Cracks Widen

Despite a benign headline close, today's tape tells a more complicated story. Real Estate and Utilities sold off hard, foreshadowing nerves over this week’s Fed decision and Wednesday’s Quarterly Refunding Announcement. With the yield curve stable but elevated, and growing concerns that Powell could be pinned between political pressure and inflation inertia, bond proxies are now shouldering the duration load.

Meanwhile, Trump’s EU tariff deal is being met with quiet discontent across Europe and skepticism in US boardrooms. A 15% tariff baseline now feels like the floor, not the ceiling. Auto-exposed names and heavy exporters dragged, and Materials suffered in kind. The China talks in Stockholm are progressing, but details remain thin — and the specter of secondary sanctions and pharma tariffs lingers in the background.

The rotation into cyclicals that held last week’s bid has turned fractured, and now the S&P’s resilience rests on a narrow group of Tech and Energy names.

A Narrow Climb Meets Macro Headwinds

What looked like a quiet session on the surface revealed deteriorating breadth and growing macro fragility. As we head into Wednesday’s triple-header — Fed decision, Powell presser, and QRA — the market is increasingly bifurcated. Tech strength is doing heavy lifting, but with defensives cracking and Financials under pressure, there's little margin for disappointment.

Earnings remain strong, but policy risk is taking center stage. Whether it’s tariffs, the Fed’s employment mandate, or the market’s dependence on ultra-low volatility, this is a week where the narrative could shift sharply.

US IG Credit Wrap: Spreads Tighten to 50.25 bp as Credit Ignores a Mounting Wall of Macro

Current IG Spread: 50.25 bp | 5-Year Avg: 62.74 bp | COVID High: 151.80 bp | Cycle Low: 43.75 bp

Investment-grade spreads remain remarkably subdued, ticking tighter to 50.25 bp as markets cling to the "Goldilocks glidepath" in the face of intensifying macro crosscurrents. While rates push higher, tariffs loom, and Fed politics heat up, credit refuses to budge. This is not disinterest… It's either confidence or willful blindness. Either way, the floor is thin.

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Macro Overlay: Credit Composure Near the Edge

Tariffs Move From Rhetoric to Risk

Trump’s tariff agenda has evolved from negotiating tactic to near-certainty. The EU accepted a 15% baseline on exports, but auto, pharma, and chip names remain in the firing line and over 200 sector-specific tariff letters are expected this week. Meanwhile, US–China talks continue in Stockholm with some positive noise, but little substance. IG paper is not reacting… yet. That’s a spread mispricing waiting to happen.

Rates Grind Up, But IG Ignores the Signal

The 10-year yield is sitting above 4.40%, and the Treasury’s $1 trillion borrowing estimate has reshaped front-end rate expectations. Still, IG spreads are glued to the floor. The dislocation between nominal yields and credit spreads is growing more severe particularly for long-duration names. If Powell leans hawkish or QRA surprises with longer-duration issuance, spread duration will matter again.

Fed Uncertainty No Longer Just About Policy

Chair Powell’s political insulation is cracking. Multiple governors may dissent this week, and Trump’s building tour isn’t just theatrics it’s a signal. The market may be underestimating how quickly a shift in leadership or messaging could hit credit’s perception of Fed reliability. This is particularly acute for the belly and long end of the curve, where investors rely on forward policy clarity to justify tight spreads.

Capex Slowdown Confirms Tariff Drag

Core capital goods orders are falling, and durable goods prints are flashing red. Even before tariffs are fully implemented, companies are reacting to the uncertainty. This should weigh on IG issuance plans and future cash flow expectations particularly in industrials and materials. Yet for now, spreads reflect no deterioration in corporate creditworthiness. That divergence won’t hold if capex weakness accelerates.

Spreads Don't Bend… They Snap

Investment-grade credit remains stoic, but the backdrop is deteriorating. You have:

A trade regime entering a chaotic final stretch,

Long-end yields grinding higher,

Corporate investment pulling back.

All while IG spreads remain pinned below their historical mean.

This isn’t just tight… Iit’s tight and brittle.

The current level reflects a market priced for perfect execution, but the margin of error is vanishing. One misstep on tariffs, one hawkish tilt from Powell, or a weak earnings signal from a major industrial or tech name and these spreads will reprice sharply.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Short-End Rates Wrap: Easing Expectations Hold at –107.3 bp as Market Awaits Fed Signal and Tariff Path Clarity

Cumulative Implied Easing (to Oct 2026): –107.3 bp

Terminal Rate: 3.257%

September OIS Cut Probability: 64.0% | Implied Rate: 4.161%

The short-end remains perched in a holding pattern, with cumulative easing priced at –107.3 bp effectively unchanged while the September cut probability clings to 64%. The curve is stable, but conviction is thin. With this week’s Fed decision and press conference looming, plus tariff headlines thickening around the US–EU deal and China talks, the market is braced but not budging.

OIS-Implied Policy Path

Macro Overlay: Calm Optics, Crowded Curve

September Still a “Live” Meeting — But Faith is Fading

The market continues to assign a ~64% chance of a cut in September, but pricing has flattened at that level. The catalyst now lies squarely in Wednesday’s Fed meeting and press conference. Powell is expected to hold rates steady, but the language especially on growth risks, tariff pass-through, and labor softening will steer whether 64% becomes 80% or collapses to 40%. A hawkish lean could steepen the front end fast.

Tariff Tail Risk Still Underappreciated

Despite a finalized EU deal and ongoing China negotiations, the tariff risk hasn't dissipated it’s metastasizing. Trump’s rhetoric is firming: 15% is the floor, not the ceiling. While Canada, the UK, and other holdouts negotiate, over 200 tariff notices are due this week. The curve still doesn’t reflect much front-loaded inflation risk, nor does it price a disruption in supply chains that could complicate rate cuts. That's a blind spot.

Fed Optics Matter More Than Ever

The politicization of the Fed continues to bubble. Trump’s visit to the central bank’s renovation site was more than symbolic it’s part of a broader effort to undermine Powell ahead of the 2025 reappointment decision. While this has no immediate impact on policy, the optics of dissent, combined with pressure from Trump-aligned governors, could shift market perception quickly if Powell’s forward guidance wavers.

Capex Cooldown Adds to Caution

Weaker-than-expected core capital goods orders and soft small-business surveys reaffirm that firms are pulling back investment. It’s not recessionary, but it is a material drag on confidence in the soft landing thesis. If July PCE or NFP data miss, the odds of a September cut could surge. But until then, the market isn’t willing to make a preemptive bet.

This Is a Curve in Stasis… Not Comfort

At –107.3 bp, the OIS curve is no longer building in more easing it's simply preserving the current expectation set. That’s a reflection of uncertainty, not confidence.

The market is betting:

Powell holds steady but nods to fall easing.

Trump’s tariff blitz is controlled, not chaotic.

Growth data cools but doesn’t crack.

That’s a fine balance, but every leg of that stool is shakier than it was two weeks ago.

The next 72 hours Powell’s tone, QRA duration bias, and the scale of tariff implementation could determine whether we stay pinned or reset materially wider.

Tactical Portfolio

Morning Trade(s) and Market thread

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.