Trades: CPI and PPI Update

The power of riding a winner

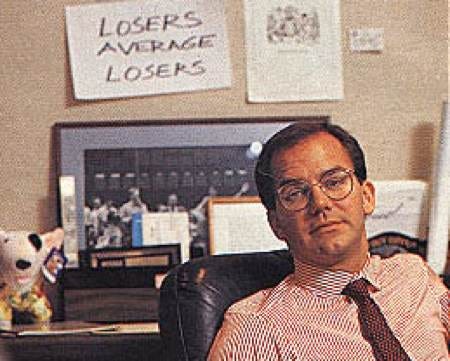

“Losers average losers”

Macro Picture:

One of the most important skills you can develop is having the perspective to interpret information and moderate your actions across MULTIPLE timeframes. For example, we are in a specific macro regime on a cyclical basis and just had two inflation prints (CPI and PPI) on an intraday basis.

People either get too focused on intraday moves or too big picture that they miss the incremental changes signaled by intraday moves.

I have laid out the macro tensions and variables in the following reports:

Equity Report: Link

Comprehensive Macro Report: Link

Alpha Report: Rates, Equities, Catalysts: Link

Critical Signal: Rates and Equities: Link

All My Equity Signals/Research YTD: Link

Current Trades: Link

Trades/Week Ahead: Inflation and Rates: Link

Interest Rate Report: Duration, TLT, and the macro cycle: Link

Macro Podcast: Rates, Recession, and Risk Assets: Link

Big Picture: We remain in a Goldilocks regime where growth is positive, inflation is falling and rate cuts are likely to start in Septemeber. Rate cuts into positive growth pushes asset prices UP.

This Week:

As we came into this week, CPI was the primary catalyst. This release came in BELOW expectations.

I have stated this over and over but everything is about CORE inflation right now. The largest line item of CORE CPI is shelter which decelerated considerably in the last print.

This is why I was VERY VERY clear about being leverage long the short end and long end into CPI for paid subscribers: Link and Link.

Now there is an important thing to observe with equity flows. On the CPI print, there was a rotation OUT of tech and INTO small caps. This was reflected in the Russell being up significantly on the day.

Why does this matter? A rotation into small caps is one of the least bearish things you could ever see in financial markets. Think about what happened during the bull market of 2021. During 2021, the highest debt and lowest quality small caps in the Russell 2000 made an incredibly rally. Now are we back in that period of time? No. But if small caps are rallying, its a signal of the TYPE of flows we are seeing.

This rally is being driven by market participants realizing we are beginning rate cuts. There is a reason homebuilders are ripping the faces off shorts since the CPI print. Rates are falling and the equity market is beginning to price in the beginning of cuts being actualized.

All of this brings us to the specific trades I have been running.

Trades:

First, I continue to hold the ES long: Link

Second, I continue to hold the Bitcoin Long: Link. Macro liquidity continues to be skewed to the upside.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.