Trades/Week Ahead: Inflation and Rates

The next step for the yield curve and how it impacts equities

One of the limitations of explaining any topic is ensuring you have the same prerequisite knowledge to understand higher-level ideas. For example, you can’t have a conversation about calculus without understanding algebra. The same is true across all domains which is why it can be difficult for more complex tensions to be communicated.

We are in a period of time in the macrocycle where a lot of tensions and false signals exist. The implication of this is you need to understand the macro regime incredibly well to make nuanced conclusions that connect to specific trades.

This is the problem for people who only use one signaling process (only technicals, only valuation, only fundamentals, only economic data, etc) for making decisions:

Big Picture:

I have laid out these tensions and variables in the following reports:

Equity Report: Link

Comprehensive Macro Report: Link

Alpha Report: Rates, Equities, Catalysts: Link

Critical Signal: Rates and Equities: Link

All My Equity Signals/Research YTD: Link

Current Trades: Link

One methodological point I want to emphasize is that you always want to be cautious of being out of sync with the market in both how its pricing uncertainty and the timeframe it’s functioning on.

If you are watching markets at least 3-4 days a week then you will see the marginal change in assets moving through catalysts and beginning to price in a specific view. I have laid out how to quantify these types of things in the intraday trading primer. Even if you aren’t trading intraday, understanding the characteristics of intraday price action during specific market regimes is critical.

You can begin to connect this with the TYPES of Markov models I have noted here:

Macro Set Up:

With this in mind, I want to touch on why I would want to be long both stocks and bonds here even if a recession is coming (still unlikely in 2024).

We don’t know if there will be a recession sometime soon. The question you should be asking is not IF there will be a recession but how you can have exposure to multiple outcomes that occur. In other words, is there a way you can make money regardless if a recession occurs or not?

This is why I have touched on being long ES (link) and bonds (link). Think about it like this:

If Goldilocks continues: Stocks up and bonds up

If a recession occurs: Stocks down and bonds up

The main idea here is that if you are holding both and they are weighted correctly then you have more positive optionality to BOTH outcomes.

Betting against Momentum on a Cyclical basis:

What people forget is that on a cyclical basis (weekly timeframe in the chart below), bonds are still in a negative momentum regime. This means once we shift impulses, CTA positioning is going to start getting very VERY long. (regimes noted in chart based on this paper: Link)

Put to call open interest in TLT 0.00%↑ is making a lower high here:

And the move index keeps trending down:

Now if you have read the macro research, the following analysis will make a lot of sense. I am going to breakdown the macro signals, technical signals, and correlations you need to be watching as we move into the next two months.

Equity Report: Link

Comprehensive Macro Report: Link

Alpha Report: Rates, Equities, Catalysts: Link

Critical Signal: Rates and Equities: Link

All My Equity Signals/Research YTD: Link

Current Trades: Link

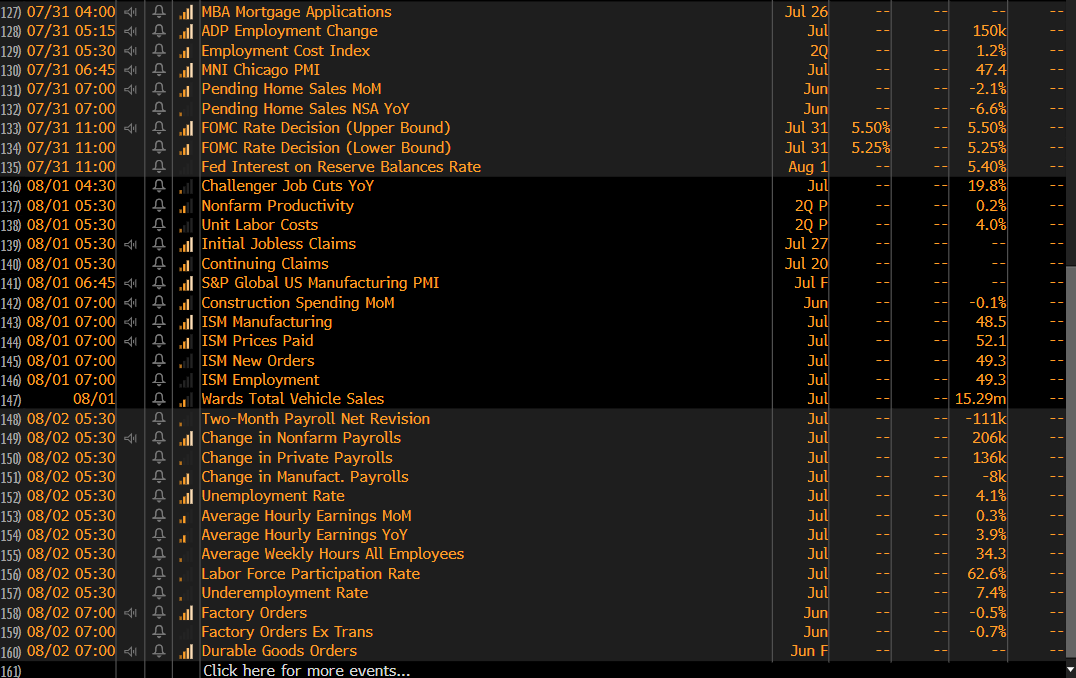

Please review the macro calendar as well:

For the month of July, we have the following catalysts:

CPI

GDP and the respective data prints feeding into GDP nowcasts such as housing data and personal income and outlays data.

PCE

PMIs

And we end the month with FOMC. NFP is the Friday after FOMC at beginning of August.

Framework, Signals and Interpretive Logic For Macro Flows:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.