Trades: Week Ahead and Updates

Equities, rates, crude, and capital flows

Hello everyone,

The views for stocks and bonds have been laid out in a clear and consistent fashion. See the following articles for the framework, skew of assets, and trades:

Comprehensive Macro Report (All the views and skew of stocks and bonds)

Capitulation: Equities and Rates (Trades)

Positioning Unwind And The Next Trade (Being long equities at the lows when everyone was dumping their exposure)

Equity Redundancy Planning (Maintaining a risk management mindset within this)

Week Ahead: Interest Rates and Equity Trades (Bullish equities last week)

Trades: TLT short and CPI analysis (Short bond view).

The macro alpha primers have begun and I will be releasing the next one very soon. See the initial one here with the podcast:

The Big Picture:

Where are we right now? We are in a Goldilocks regime and almost at the end of a positioning unwind mean reverting. We sold off considerably post-FOMC and have made a vicious rally back to the FOMC level.

Why does this matter? Well the macro regime continues to skew equities to the upside and we are moving into the next Powell speech. While consensus continues to think 50bps is on the table, this is HIGHLY unlikely. I laid this out with explicit clarity in macro report.

We have had a reasonable repricing of the Sept contract to a 24% probability of a 50bps cut. We still have some time before the meeting for this to get shaken out in an orderly fashion.

I laid out in the macro report that bonds held a neutral risk reward until the Sept meeting. I also shared this risk-reward after the CPI print (link). I explained in my analysis on the long end that you need to be careful here because bonds are clearly skewed bullish on a cyclical basis but we need to see some short term repricing for the durability of the trend to remain. I still think we move down marginally to shock positioning marginally. However, the long equity and Bitcoin trade have significantly better risk reward.

The Bitcoin view I shared remains (link). The macro-environment remains supportive of Bitcoin and is absorbing the supply of the idiosyncratic factors.

As I mentioned in the Bitcoin podcast (link), interest rate cuts into resilient growth with a bull steepening in the curve and rally in gold is incredibly bullish for Bitcoin. The conditions exist for this rally and the position flush we saw to 50k two weeks ago provides clarity on where we can place our stops. The signal-to-noise ratio is very clear.

See the Bitcoin Primer I wrote here:

Turning to crude, the short oil trade noted in the chat has continued to pay dividends.

Notice how crude falling isn’t always correlated with bonds rallying? This is because commodities are not the only input into inflation. Crude likely has additional downside from here but I wouldn’t not be opening any new longs.

Additional Notes and Observations:

Implied vol premiums across equity indices have fallen considerably. As volatility ranges tighten again, I will begin tightening the stops I have for trades that are onside. You execute when extremes in implied vol premiums exist and then hold positions as they trend.

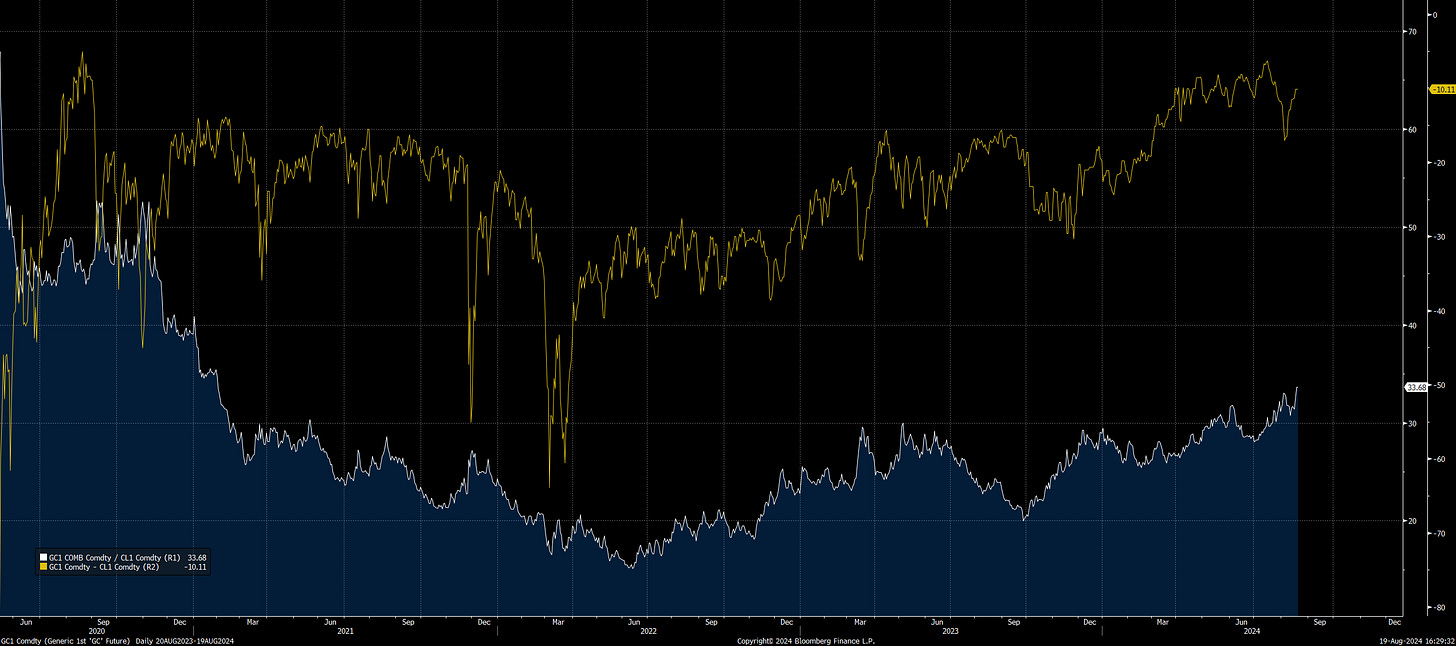

I am watching the gold-to-crude ratio closely right now (white line) as well as their implied vol differentials (yellow). As gold rallies and crude falls, we are likely to see some type of capitulatory momentum that might overlap with a move in bonds. If this occurs, I might be taking the other side of it but it is unclear if it should be expressed in a ratio, calendar trade, or outright contract.

As a big picture note please remember two things:

The inflation hedging pressures continue to decrease. This means growth prints are likely to have a larger impact on equities and bonds moving forward. Even if it’s a growth scare, traders are going to be hedging into events like NFP and initial claims more aggressively now (this is premium to extract on a macro basis).

Net position in equities remains short but not as aggressive as 2023:

The positioning unwind gave us a clear signal for positioning on a short-term basis but as we move back up to all-time highs, betting on breakouts and momentum will be the higher expectancy play than waiting for additional dips where vol blows out.

The final thing I will say is to watch Copper closely here. We have been trending down for a while now and we just printed positive returns for last week after the liquidation in metals at the beginning of August. We could move considerably higher from here:

As always, a Pepe for the culture!

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

“As gold rallies and crude falls, we are likely to see some type of capitulatory momentum that might overlap with a move in bonds.” Mind sharing a few more words on why?

> Net position in equities remains short but not as aggressive as 2023:

When you say this how are you measuring net positioning? What do the `CFF6TNCN` and `IMMOENCN` tell you exactly?

I see these being negative (red bars) yet see the corresponding indices rise in price, which is confusing