Macro Inflection Points: Momentum Turning Points

Positioning and momentum

In today’s article, I want to cover four relevant topics connected to the macro regime we are in and the price action we are likely to see in the coming weeks:

How macro regimes function as expressed in price

Bitcoin and ES trades

ES Levels

The Bond Trade / TLT

“The first thing I heard when I got in the business, not from my mentor, was bulls make money, bears make money, and pigs get slaughtered. I'm here to tell you I was a pig. And I strongly believe the only way to make long-term returns in our business that are superior is by being a pig.”

Stanley Druckenmiller

Macro Regimes:

I have already laid out the TYPES of regimes and how to quantify them in this article:

The Research Hub: Risk On / Risk Off Regimes

Hey everyone, There is a lot of discussion out there as to if we are still in a bear market or have entered a new bull market. What complicates things further is everyone seems to have a different definition of a bull or bear market that they assert is “the correct definition”, as if something could even be possible.

All of the educational primers for macro and regime identification are here:

Research Synthesis / Direction Of Capital Flows Substack

Hello everyone, There has never been a time in history when understanding the world from a global perspective and interpreting it accurately paid such a high premium. Since the very beginning of this Substack, I have talked about the nature of the time we live in and how to act intentionally in it.

Big picture, when we think about the spectrum of assets, some of these assets exhibit more mean reversion than others.

For the sake of showing the extremes, Nat gas goes to an extreme and then mean reverts. Nat gas doesn’t just go up and to the right. (The top panel shows time-series momentum regimes and the bottom panel shows the Z-Score).

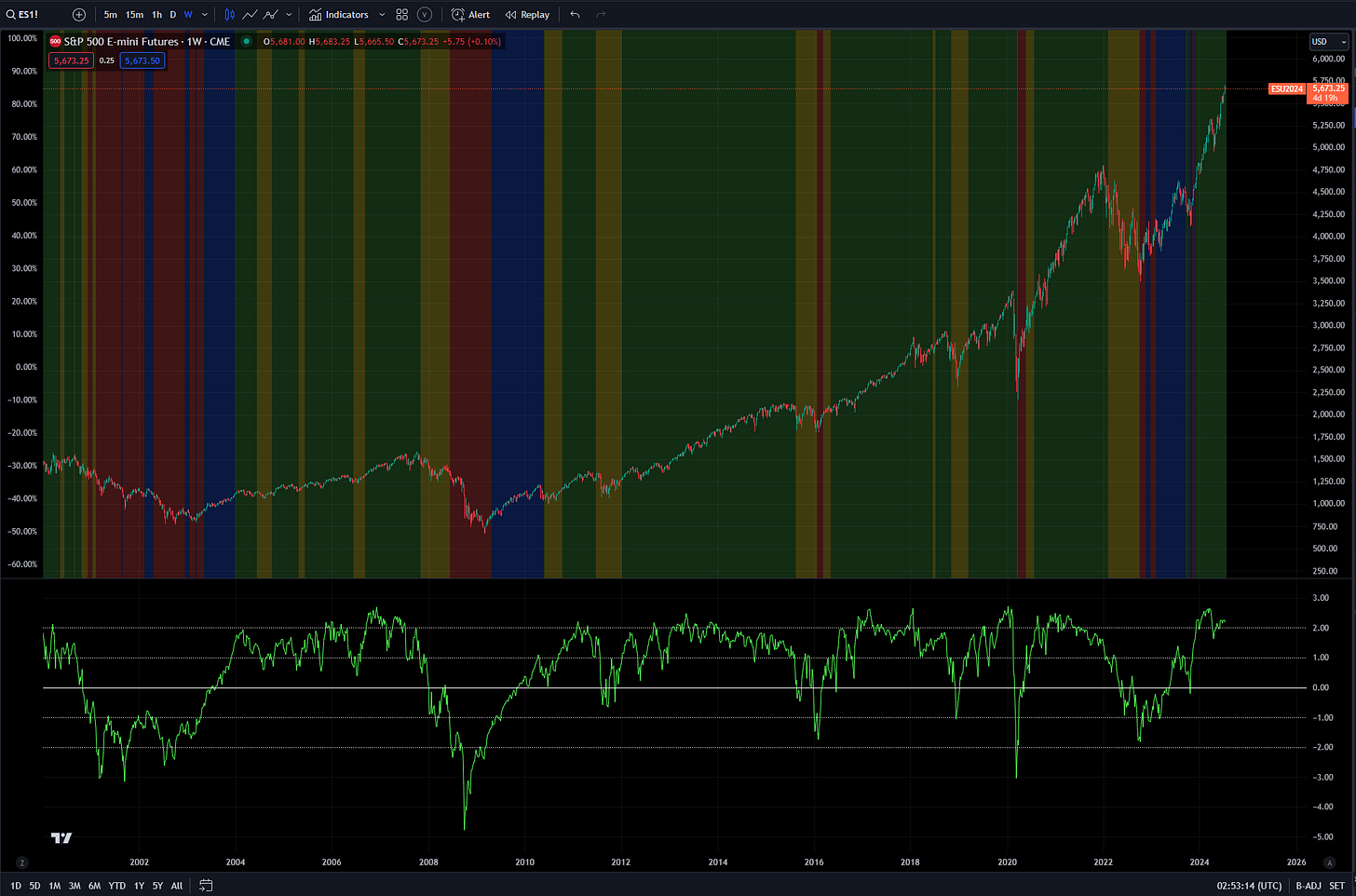

On the other end of the spectrum, we have the S&P500 which functionally trends up and to the right over time.

Now the important point here is the TYPE of price action taking place. Every asset in the world typically falls somewhere on the spectrum between these two extremes. There are reasons for this but we don’t have the time to go over it today.

In the case of bonds, we have sold off to a significant extreme over the past 3 years. The standard deviation we have hit on a long-term basis isn’t incredibly common.

I have laid out the framework for bonds here:

Why does this matter? Well, the question is, can you simply buy and hold the asset or do you need to have some type of timing? For example, if you simply buy and hold nat gas, the probability isn’t necessarily stacked in your favor to make money if you “just hold long enough.” The S&P500 is a different story. There are no guarantees in markets but “positive expectancy” is a real thing.

The question for bonds is, are we going to eventually mean revert back up to the historical trend?

Here is what I will say on this issue: Fundamentally, momentum or mean reversion in any asset is going to be dependent on the underlying macro regime. The degree of momentum or mean reversion an asset has in its price is determined by where it falls on its exposure to the entire economy and financial system. Nat gas has a very different exposure to the world than the S&P500. Those who are in the macro/quant space are constantly quantifying the TYPE of price action characteristics that assets have in order to align their actions to them. Even if you aren’t sure of directionality, understanding the TYPE of price action allows you to be wrong much faster and thereby limit losses.

Bonds have sold off multiple standard deviations from its long-term trend. The impulse that caused this sell-off has faded. The question now is, will this trend reverse and if it does, will it be soon? Managing this uncertainty is what this Substack is all about.

I have laid this logic for the regime and trades I am running with it in this report:

Trades: CPI and PPI Update

“Losers average losers” Macro Picture: One of the most important skills you can develop is having the perspective to interpret information and moderate your actions across MULTIPLE timeframes. For example, we are in a specific macro regime on a cyclical basis and just had two inflation prints (CPI and PPI) on an intraday basis.

The important thing to remember is that macro is all about dynamically adapting on the fly. It is not about copy trading here or there. It is about understanding the logic and casual drivers of flows in a situation so that you can know exactly when you are right and when you are wrong.

Bitcoin and ES trades

This context for macro regimes frames how to think about Bitcoin. Fundamentally, Bitcoin is in a mean reversion range on a short-term basis. This is due to positioning in idiosyncratic events such as the Bitcoin ETF, Germany selling, the US selling, and some other players.

However, the macro liquidity regime remains skewed to the upside. As I laid out, Bitcoin is a liquidity release valve.

Trade: Bitcoin Long

Hello everyone, I have laid out how this week and the month of July are likely to play out given the macro skew and catalysts. We are likely to see risk assets rally as we see a bull steepening into positive real growth. In other words, when the price of money drops in the system and growth remains constant, assets are the release valve to price this di…

My Bitcoin strategy that synthesized the macro factors and price action regime opened a long at $57,150. We are now at $62,613. Again, when you have rate cuts into an economy with resilient growth, this is a huge positive liquidity impulse.

This is exactly why I am holding the long ES trade as well:

Trades: Long ES

I have laid out the tensions for the macro situation and my view on equities: Trades/Week Ahead: Rates, GDP and Inflation Print (macro context for this week) Asset Class Report: Equities (I broke down the R:R of equities) Interest Rate Report: Strategy and Trades

There are some important signals to be watching for Bitcoin, ES, and bonds as we move into the end of the month. I have already framed the initial context for July here:

Trades/Week Ahead: Inflation and Rates

One of the limitations of explaining any topic is ensuring you have the same prerequisite knowledge to understand higher-level ideas. For example, you can’t have a conversation about calculus without understanding algebra. The same is true across all domains which is why it can be difficult for more complex tensions to be communicated.

After the CPI and PPI print last week, this week will be important.

ES Levels:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.