The Big Picture For Equities and Rates

Trade updates and how to think about sequential actions

Hello everyone,

There are a lot of new people joining so I want to welcome you to the Capital Flows Substack. This is the place where I share all of my research, ideas, and trades for financial markets and life. If you are brand new and trying to get your barings, I have aggregated all of the educational primers in one place. There are comprehensive primers on how to think about equities, rates and overall macro. I have provided extensive lists of additional academic resources in each so that it will provide value to someone who is brand new or has been around markets for a while.

I will just say this, I move pretty fast in my research, reading, and learning process (I laid out how I do this here: Link). Try to keep up as best as possible. If it feels like a lot, that’s good. It means your being stretched and growing.

In this article, I’m going to split things into three parts:

Part 1: Sequential action as it connects to the intertemporal nature of markets (and life).

Part 2: A big picture overview of where we are with rates and equities in the economic cycle.

Part 3: A technical breakdown of the trades and specific variables you should be monitoring for macro flows this week

Part 1: Sequential action as it connects to the intertemporal nature of markets (and life):

Markets are about managing uncertainty of the future but the way in which they express time preference is constantly shifting. In markets, there is an intertemporal nature where it isn’t just about getting from point a to b but also how time functions IN BETWEEN these two points. In a world where the degree of expected vs realized returns in markets is always shifting, you need to manage how time preferences are dynamically changing. For example, the macro situation can remain relatively constant in its growth and inflation elements. However, risk assets can rally or sell off as the degree to which returns are realized shifts with positioning.

If markets have an intertemporal dimension then sequential action must be taken into account. What does this mean? It means that your action or inaction today sets the stage for your action tomorrow. The implication is that being successful in markets (and life) is about having the foresight to understand your accomplishments are the sum of sequentially connected actions as opposed to a single action on a single day.

This is why market timing and scenario analysis are critical for having foresight in your decision making.

Now the timing of these decisions will be individualized for each person. Sometimes this means you will make 3-4 decisions every cycle. If you are more on the active side then you might make 3-4 decisions every month or even week. This is where understanding the macro flows on multiple time frames is critical.

Part 2: A big picture overview of where we are with rates and equities in the economic cycle:

I want to zoom out a little and talk about where we are in the overall macro cycle. It is incredibly easy to get lost in the weeds and forget what the cyclical impulses of things are.

First, interest rates on the short end of the curve have topped at 5%. It is incredibly unlikely that we move above 5% especially given the developments that have taken place over the last month.

If you want to dig into the interest rate research I’ve written recently, its here:

Fundamentally, the long end of the curve is going to be driven by expectations of the short end + term premia (see my conversation with Prometheus Research on this here: Link). What does this mean? It means if the short end is going down, there is minimal upside in the 10 year interest rate. In the strategies I am running, it is unlikely that we make new highs in the 10 year from here:

Nominal rates are made up of the real rate component and inflation expectation component (see primers for interest rates here and here). Right now inflation expectations are rolling over and likely to move back BELOW 2.50%

We can go through all of the reasons but we arent seeing the same type of inflationary impulse in the economy right now. Inventory to sales ratios have risen considerably and interest rates are well above headline and core inflation.

The implication of this is that we are in a period of transition. The inflationary impulse in markets is decreasing and rates have a high probability of decelerating as we move into the end of the year.

One of the things I noted in the macro report (link) was that the fall in the economic surprise index was connected to the YTD rise we saw in rates. The chart below is the economic surprise index (blue) and 10 year interest rates (white):

This fall in the economic surprise index has led a marginal softening in the Atlanta Fed GDP Nowcast. However, you need to be careful overextrapolating this.

We are moving into the next FOMC with a marginal softening in growth:

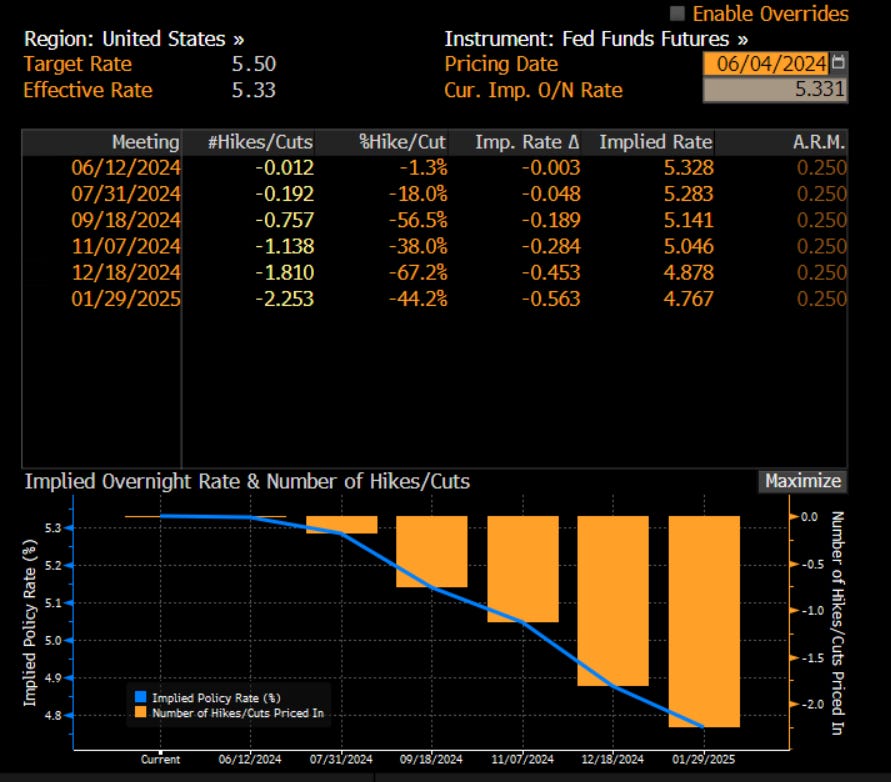

But a July rate cut is still unlikely. We still need to price a higher probability of cuts in the following months though:

All of these variables will set the context for how the NFP print comes out this Friday. I laid this context out here:

This macro regime brings us to equities and their respective drivers. Fundamentally, we are in a bullish regime for equities on a weekly time horizon.

Short term momentum remains skewed to the upside as well:

Big picture:

The macro impulse in markets is one of positive growth and positive liquidity. This creates an incredibly attractive regime for equities.

While inflation is falling marginally and could put some pressure on top line sales numbers, we are not anywhere near this yet.

The deceleration in the recent inflation prints caused the momentum trade in growth tech to rally considerably. My partner Said has been drawing attention to this on the SpearPoint Equity Alpha publication. If you want to hear about how we synthesize our views and connect them to specific trades, check out the intro podcast we did for the publication. SpearPoint Equity Alpha is a separate publication so be sure to subscribe to that one for the individual equity trades by Said.

The most recent piece on positioning is really good

Pulling these dynamics together, this is why I opened the long ES trade. I shared this with everyone along with my bullish equity view:

The original R:R I shared in the long ES trade article:

and here is where we are now: In the money on the trade:

Getting the right entires for these trades is critical because you want to execute at extremes when the risk-reward ratio is the highest. This is the only way to consistently make money. With this being said, let’s transition into part 3 where I want to touch on the interest rate trades a bit more.

Part 3: A technical breakdown of the trades and specific variables you should be monitoring for macro flows this week:

There are several important things to monitor for the trades I have shared:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.